Panera Bread 2009 Annual Report Download - page 65

Download and view the complete annual report

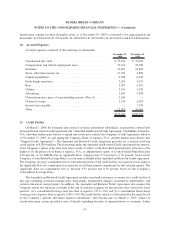

Please find page 65 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2009, which resulted in a $0.1 million increase to goodwill, and $0.2 million of adjustments during fiscal 2008,

which resulted in a net $0.2 million increase to goodwill, and approximately $0.2 million of adjustments during

fiscal 2007, which resulted in a net $0.2 million decrease to goodwill in the Consolidated Balance Sheets as a result

of the settlement of certain purchase price adjustments. Further, the pro forma impact of the acquisitions on prior

periods is not presented, as the impact of the series of individually immaterial business combinations completed

during fiscal 2007 were not material in the aggregate to reported results.

During the fiscal years ended December 30, 2008 and December 25, 2007, the Company paid approximately

$2.5 million and $9.6 million, including accrued interest, of previously accrued acquisition purchase price in

accordance with the asset purchase agreements, respectively. There was no accrued purchase price payments made

in the fiscal year ended December 29, 2009. There was no contingent or accrued purchase price remaining as of

December 29, 2009 or December 30, 2008.

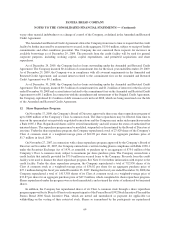

4. Noncontrolling Interest

Effective December 31, 2008, the first day of fiscal 2009, the Company implemented the accounting standard

for the reporting of noncontrolling interests in the Company’s consolidated financial statements and accompanying

notes. This standard changed the accounting and reporting for minority interests, which are to be recorded initially

at fair market value and reported as noncontrolling interests as a component of equity, separate from the parent

company’s equity. Purchases or sales of noncontrolling interests that do not result in a change in control are to be

accounted for as equity transactions. In addition, net income attributable to the noncontrolling interest is to be

included in consolidated net income in the Consolidated Statements of Operations and upon a loss of control, the

interest sold, as well as any interest retained, will be recorded at fair value with any gain or loss recognized in

earnings. The Company has applied these presentation and disclosure requirements retrospectively.

During fiscal 2009, the Company recorded an adjustment of $0.7 million to noncontrolling interest to reflect

deferred taxes prior to the purchase of the remaining 49 percent of Paradise. This adjustment was recorded to

additional paid-in capital as a result of the June 2, 2009 purchase of the remainder of Paradise.

Purchase of Noncontrolling Interest

On February 1, 2007, the Company purchased 51 percent of the outstanding stock of Paradise, then owner and

operator of 22 bakery-cafes and one commissary and franchisor of 22 bakery-cafes and one commissary, for a

purchase price of $21.1 million plus $0.5 million in acquisition costs. As a result, Paradise became a majority-

owned consolidated subsidiary of the Company, with its operating results included in the Company’s Consolidated

Statements of Operations and the 49 percent portion of equity attributable to Paradise presented as minority interest,

and subsequently as noncontrolling interest, in the Company’s Consolidated Balance Sheets. In connection with this

transaction, the Company received the right to purchase the remaining 49 percent of the outstanding stock of

Paradise after January 1, 2009 at a contractually determined value, which approximated fair value. In addition, the

related agreement provided that if the Company did not exercise its right to purchase the remaining 49 percent of the

outstanding stock of Paradise by June 30, 2009, the remaining Paradise owners had the right to purchase the

Company’s 51 percent interest in Paradise thereafter for $21.1 million.

On June 2, 2009, the Company exercised its right to purchase the remaining 49 percent of the outstanding stock

of Paradise, excluding certain agreed upon assets totaling $0.7 million, for a purchase price of $22.3 million,

$0.1 million in transaction costs, and settlement of $3.4 million of debt owed to the Company by the shareholders of

the remaining 49 percent of Paradise. Approximately $20.0 million of the purchase price, as well as the transaction

costs, were paid on June 2, 2009, with $2.3 million retained by the Company for certain holdbacks. The holdbacks

are primarily for certain indemnifications and expire on the second anniversary of the transaction closing date,

June 2, 2011, with any remaining holdback amounts reverting to the prior shareholders of the remaining 49 percent

of Paradise. The transaction was accounted for as an equity transaction, by adjusting the carrying amount of the

noncontrolling interest balance to reflect the change in the Company’s ownership interest in Paradise, with the

59

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)