Panera Bread 2009 Annual Report Download - page 37

Download and view the complete annual report

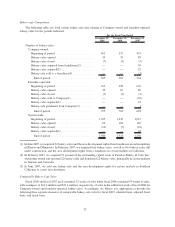

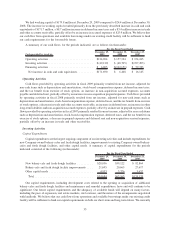

Please find page 37 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.open in the next four to five years. An ADA requires a franchisee to develop a specified number of bakery-cafes on

or before specific dates. If a franchisee fails to develop bakery-cafes on schedule, we have the right to terminate the

ADA and develop Company-owned locations or develop locations through new area developers in that market. We

may exercise one or more alternative remedies to address defaults by area developers, including not only

development defaults, but also defaults in complying with our operating and brand standards and other covenants

under the ADAs and franchise agreements. We may waive compliance with certain requirements under its ADAs

and franchise agreements when it determines that such action is warranted under the particular circumstances.

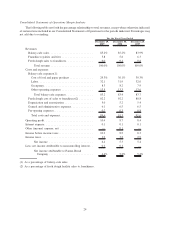

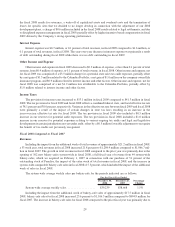

Including the impact from the additional week of fresh dough sales to franchisees of approximately

$2.2 million in fiscal 2008, fresh dough sales to franchisees in fiscal 2008 increased 12.6 percent to $117.8 million

compared to $104.6 million in fiscal 2007. The increase in fresh dough sales to franchisees was primarily driven by

the previously described increased number of franchise-operated bakery-cafes opened since the prior fiscal year,

higher overall franchise-operated bakery-cafe sales demonstrated by the 5.3 percent increase in comparable

franchise-operated bakery-cafe sales percentages in fiscal 2008, which included the additional week of sales,

increases in our sales prices of dough products to franchisees compared to the same periods in the prior year, and the

impact of the extra week of sales in fiscal 2008.

Costs and Expenses

The cost of food and paper products includes the costs associated with the fresh dough operations that sell fresh

dough products to Company-owned bakery-cafes, as well as the cost of food and paper products supplied by third-

party vendors and distributors. The costs associated with the fresh dough operations that sell fresh dough products to

franchise-operated bakery-cafes are excluded and are shown separately as fresh dough cost of sales to franchisees in

the Consolidated Statements of Operations.

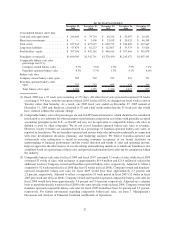

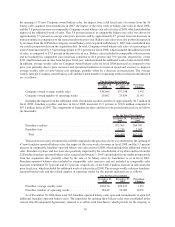

The cost of food and paper products was $332.7 million, or 30.1 percent of bakery-cafe sales in fiscal 2008

compared to $271.4 million or 30.3 percent of bakery-cafe sales in fiscal 2007. Despite significant increases in input

costs, we slightly decreased the cost of food and paper products percent of bakery-cafe sales rate through several

means, including category management initiatives, leverage from higher sales prices, and improved leverage of our

fresh dough manufacturing costs due to additional bakery-cafe openings. In fiscal 2008, there was an average of

62.0 bakery-cafes per fresh dough facility compared to an average of 55.8 for the same fiscal period in 2007.

Partially offsetting these decreases were significant commodity cost increases on primarily wheat and diesel,

coupled with general inflationary cost increases.

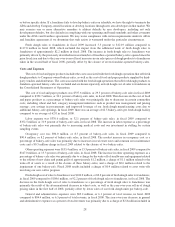

Labor expense was $352.5 million, or 31.9 percent of bakery-cafe sales in fiscal 2008 compared to

$286.2 million, or 32.0 percent of bakery-cafe sales, in fiscal 2007. The labor expense as a percentage of

bakery-cafe sales remained fairly consistent between the 2008 and 2007 fiscal years primarily as a result of the

reduction in fixed labor costs from the removal of Crispani»from the bakery-cafes in the first quarter of 2008 and

leverage from higher sales prices, offset partially by labor inefficiencies resulting from lower transaction levels and

a modest effect from higher self-insured benefits expense and normalized incentive compensation levels in fiscal

2008 as compared to fiscal 2007.

Occupancy cost was $90.4 million, or 8.2 percent of bakery-cafe sales, in fiscal 2008 compared to

$70.4 million, or 7.9 percent of bakery-cafe sales, in fiscal 2007. The increase in occupancy cost as a percentage

of bakery-cafe sales between the 2008 and 2007 fiscal years was primarily due to rising average per square foot

costs driven by our expansion into newer, higher cost markets, such as those on the West Coast, and, less

significantly, due to the increasing numbers of urban, free-standing and drive-thru bakery-cafe locations.

Other operating expenses were $147.0 million, or 13.3 percent of bakery-cafe sales, in fiscal 2008 compared to

$121.3 million, or 13.6 percent of bakery-cafe sales, in fiscal 2007. The decrease in other operating expenses rate

between the 2008 and 2007 fiscal years was primarily due to improved leverage of our expenses due to higher sales

coupled with disciplined management of controllable expenses, partially offset by a charge of $0.4 million related

to asset write-offs involving our new coffee program.

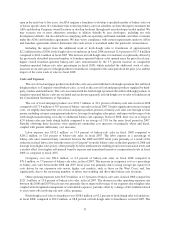

Fresh dough cost of sales to franchisees was $108.6 million, or 92.2 percent of fresh dough sales to franchisees,

in fiscal 2008, compared to $92.9 million, or 88.8 percent of fresh dough sales to franchisees, in fiscal 2007. The

31