Panera Bread 2009 Annual Report Download - page 73

Download and view the complete annual report

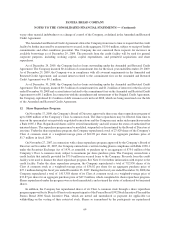

Please find page 73 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approximately Cdn.$3.7 million. On April 7, 2009, Millennium requested a Cdn.$3.5 million advance under the

Credit Agreement, which was applied against the outstanding receivable as previously described. The remaining

Cdn.$0.2 million receivable was resolved during fiscal 2009. The Cdn. $3.5 million note receivable from

Millennium is included in other accounts receivable in the Consolidated Balance Sheets as of December 29, 2009.

Legal Proceedings

On January 25, 2008 and February 26, 2008, purported class action lawsuits were filed against the Company

and three of the Company’s current or former executive officers by the Western Washington Laborers-Employers

Pension Trust and Sue Trachet, respectively, on behalf of investors who purchased the Company’s common stock

during the period between November 1, 2005 and July 26, 2006. Both lawsuits were filed in the United States

District Court for the Eastern District of Missouri, St. Louis Division. Each complaint alleges that the Company and

the other defendants violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and Rule 10b-5 under the Exchange Act in connection with the Company’s disclosure of system-

wide sales and earnings guidance during the period from November 1, 2005 through July 26, 2006. Each complaint

seeks, among other relief, class certification of the lawsuit, unspecified damages, costs and expenses, including

attorneys’ and experts’ fees, and such other relief as the Court might find just and proper. On June 23, 2008, the

lawsuits were consolidated and the Western Washington Laborers-Employers Pension Trust was appointed lead

plaintiff. On August 7, 2008, the plaintiff filed an amended complaint, which extended the class period to

November 1, 2005 through July 26, 2007. The Company believes that it and the other defendants have meritorious

defenses to each of the claims in this lawsuit and the Company is vigorously defending the lawsuit. On October 6,

2008, the Company filed a motion to dismiss all of the claims in this lawsuit. Following filings by both parties on the

Company’s motion to dismiss, on June 25, 2009, the Court converted the Company’s motion to one for summary

judgment and denied it without prejudice. The Court simultaneously gave the Company until July 20, 2009 to file a

new motion for summary judgment, which deadline the Court subsequently extended until August 10, 2009. On

August 10, 2009, the Company filed a motion for summary judgment. On September 9, 2009, the plaintiff filed a

request to deny or continue the Company’s motion for summary judgment to allow the plaintiff to conduct

discovery. Following a hearing and subsequent filings by both parties on the plaintiff’s request for discovery, on

November 6, 2009, the Court denied the plaintiff’s request. The plaintiff filed an opposition to the Company’s

motion for summary judgment on December 12, 2009, and the Company filed its reply in support of its motion on

December 21, 2009. The Company’s motion for summary judgment is pending as of the date of this filing. There

can be no assurance that the Company will be successful, and an adverse resolution of the lawsuit could have a

material adverse effect on the Company’s consolidated financial position and results of operations in the period in

which the lawsuit is resolved. The Company is not presently able to reasonably estimate potential losses, if any,

related to the lawsuit and as such, has not recorded a liability in its Consolidated Balance Sheets.

On February 22, 2008, a shareholder derivative lawsuit was filed against the Company as nominal defendant

and against certain of its current or former officers and certain current directors. The lawsuit was filed by Paul

Pashcetto in the Circuit Court of St. Louis, Missouri. The complaint alleges, among other things, breach of fiduciary

duty, abuse of control, waste of corporate assets and unjust enrichment between November 5, 2006 and February 22,

2008. The complaint seeks, among other relief, unspecified damages, costs and expenses, including attorneys’ fees,

an order requiring the Company to implement certain corporate governance reforms, restitution from the defendants

and such other relief as the Court might find just and proper. The Company believes that it and the other defendants

have meritorious defenses to each of the claims in this lawsuit and the Company is vigorously defending the lawsuit.

On July 18, 2008, the Company filed a motion to dismiss all of the claims in this lawsuit. Following filings by both

parties on the Company’s motion to dismiss, on December 14, 2009, the Court denied the Company’s motion. The

Company filed an answer to the complaint on January 27, 2010. There can be no assurance that the Company will be

successful, and an adverse resolution of the lawsuit could have a material adverse effect on the Company’s

consolidated financial position and results of operations in the period in which the lawsuit is resolved. The

67

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)