Panera Bread 2009 Annual Report Download - page 70

Download and view the complete annual report

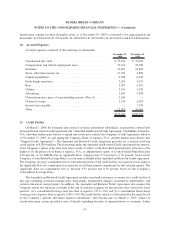

Please find page 70 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to pay other material indebtedness or a change of control of the Company, as defined in the Amended and Restated

Credit Agreement.

The Amended and Restated Credit Agreement allows the Company from time to time to request that the credit

facility be further increased by an amount not to exceed, in the aggregate, $150.0 million, subject to receipt of lender

commitments and other conditions precedent. The Company has not exercised these requests for increases in

available borrowings as of December 29, 2009. The proceeds from the credit facility will be used for general

corporate purposes, including working capital, capital expenditures, and permitted acquisitions and share

repurchases.

As of December 29, 2009, the Company had no loans outstanding under the Amended and Restated Credit

Agreement. The Company incurred $0.4 million of commitment fees for the fiscal year ended December 29, 2009.

As of December 29, 2009, the Company was in compliance with all covenant requirements in the Amended and

Restated Credit Agreement, and accrued interest related to the commitment fees on the Amended and Restated

Credit Agreement was $0.1 million.

As of December 30, 2008, the Company had no loans outstanding under the Amended and Restated Credit

Agreement. The Company incurred $0.3 million of commitment fees and $1.2 million of interest for the fiscal year

ended December 30, 2008 and accrued interest related to the commitment fees on the Amended and Restated Credit

Agreement was $0.1 million. In connection with the amendment and restatement of the Original Credit Agreement,

the Company capitalized $1.2 million of debt issuance costs in fiscal 2008, which are being amortized over the life

of the Amended and Restated Credit Agreement.

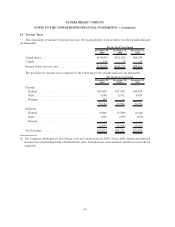

12. Share Repurchase Program

On November 17, 2009, the Company’s Board of Directors approved a three year share repurchase program of

up to $600 million of the Company’s Class A common stock. The share repurchases may be effected from time to

time on the open market or in privately negotiated transactions and the Company may make such repurchases under

a Rule 10b5-1 Plan. Repurchased shares will be retired immediately and will resume the status of authorized but

unissued shares. The repurchase program may be modified, suspended, or discontinued by the Board of Directors at

any time. Under the share repurchase program, the Company repurchased a total of 27,429 shares of the Company’s

Class A common stock at a weighted-average price of $62.98 per share for an aggregate purchase price of

$1.7 million in fiscal 2009.

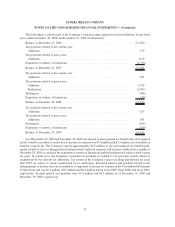

On November 27, 2007, in connection with a share repurchase program approved by the Company’s Board of

Directors on November 20, 2007, the Company entered into a written trading plan in compliance with Rule 10b5-1

under the Securities Exchange Act of 1934, as amended, to purchase up to an aggregate of $75.0 million of the

Company’s Class A common stock, subject to maximum per share purchase price. The Company entered into a

credit facility that initially provided for $75.0 million in secured loans to the Company. Proceeds from the credit

facility were used to finance the share repurchase program. See Note 11 for further information with respect to the

credit facility. Under the share repurchase program, the Company repurchased a total of 752,930 shares of its

Class A common stock at a weighted-average price of $36.02 per share for an aggregate purchase price of

$27.1 million during the fiscal year ended December 25, 2007. During the fiscal year ended December 30, 2008, the

Company repurchased a total of 1,413,358 shares of its Class A common stock at a weighted-average price of

$33.87 per share for an aggregate purchase price of $47.9 million, which completed its share repurchase program.

Shares repurchased under the program were retired immediately and resumed the status of authorized but unissued

shares.

In addition, the Company has repurchased shares of its Class A common stock through a share repurchase

program approved by its Board of Directors from participants of the Panera Bread 1992 Stock Incentive Plan and the

Panera Bread 2006 Stock Incentive Plan, which are netted and surrendered as payment for applicable tax

withholding on the vesting of their restricted stock. Shares so surrendered by the participants are repurchased

64

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)