Panera Bread 2009 Annual Report Download - page 60

Download and view the complete annual report

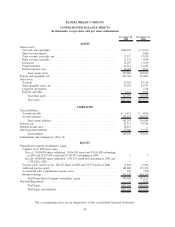

Please find page 60 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accounting standard for property, plant and equipment, specifically related to the accounting for the impairment or

disposal of long-lived assets.

Deferred Financing Costs

Debt issuance costs incurred in connection with the issuance of long-term debt are capitalized and amortized to

interest expense based on the related debt agreement using the straight-line method, which approximates the

effective interest method. The unamortized amounts are included in deposits and other assets in the Consolidated

Balance Sheets and were $0.8 million and $1.1 million at December 29, 2009 and December 30, 2008, respectively.

Revenue Recognition

The Company records revenue from bakery-cafe sales upon delivery of the related food and other products to

the customer. Revenue from fresh dough sales to franchisees is also recorded upon delivery.

The Company records a liability in the period in which a gift card is issued and proceeds are received. As gift

cards are redeemed, this liability is reduced and revenue is recognized.

Franchise fees are the result of the sale of area development rights and the sale of individual franchise locations

to third parties. The initial franchise fee is generally $35,000 per bakery-cafe to be developed under the Area

Development Agreement (“ADA”). Of this fee, $5,000 is generally paid at the time of the signing of the ADA and is

recognized as revenue when it is received, as it is non-refundable and the Company has to perform no other service

to earn this fee. The remainder of the fee is paid at the time an individual franchise agreement is signed and is

recognized as revenue upon the opening of the bakery-cafe. Franchise fees were $1.2 million, $2.2 million, and

$2.6 million for the fiscal years ended December 29, 2009, December 30, 2008, and December 25, 2007,

respectively. Royalties are generally paid weekly based on the percentage of sales specified in each ADA (generally

4 percent to 5 percent of sales). Royalties are recognized as revenue when they are earned. Royalties were

$77.1 million, $72.6 million, and $64.6 million for the fiscal years ended December 29, 2009, December 30, 2008,

and December 25, 2007, respectively.

Advertising Costs

National advertising fund and marketing administration contributions received from franchise-operated

bakery-cafes are consolidated with those from the Company in the Company’s consolidated financial statements.

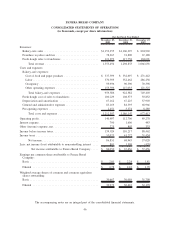

Liabilities for unexpended funds received from franchisees are included in accrued expenses in the Consolidated

Balance Sheets. The Company’s contributions to the national advertising and marketing administration funds are

recorded as part of general and administrative expenses in the Consolidated Statements of Operations, while the

Company’s own local bakery-cafe media costs are recorded as part of other operating expenses in the Consolidated

Statements of Operations. The Company’s policy is to record advertising costs as expense in the period in which the

cost is incurred. The Company’s advertising costs include national, regional and local expenditures utilizing

primarily radio, billboards, social networking, television, and print. The total amounts recorded as advertising

expense were $15.3 million, $14.2 million, and $10.8 million for the fiscal years ended December 29, 2009,

December 30, 2008, and December 25, 2007, respectively.

Pre-Opening Expenses

All pre-opening costs directly associated with the opening of new bakery-cafe locations, which consists

primarily of pre-opening rent expense, labor and food costs incurred during in-store training and preparation for

opening, but exclude manager training costs which are included in other operating expenses in the Consolidated

Statements of Operations, are expensed when incurred.

54

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)