Panera Bread 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

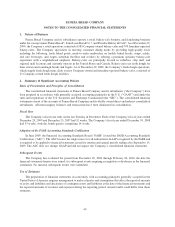

1. Nature of Business

Panera Bread Company and its subsidiaries operate a retail bakery-cafe business and franchising business

under the concept names Panera Bread», Saint Louis Bread Co.», and Paradise Bakery & Café». As of December 29,

2009, the Company’s retail operations consisted of 585 Company-owned bakery-cafes and 795 franchise-operated

bakery-cafes. The Company specializes in meeting consumer dining needs by providing high quality food,

including the following: fresh baked goods, made-to-order sandwiches on freshly baked breads, soups, salads,

and cafe beverages, and targets suburban dwellers and workers by offering a premium specialty bakery-cafe

experience with a neighborhood emphasis. Bakery-cafes are principally located in suburban, strip mall, and

regional mall locations and currently operate in the United States and Canada. Bakery-cafes use fresh dough for

their artisan and sourdough breads and bagels. As of December 29, 2009, the Company’s fresh dough operations,

which supply fresh dough items daily to most Company-owned and franchise-operated bakery-cafes, consisted of

21 Company-owned fresh dough facilities.

2. Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The consolidated financial statements of Panera Bread Company and its subsidiaries (“the Company”) have

been prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”) and under the

rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). The consolidated financial

statements consist of the accounts of Panera Bread Company and its wholly owned direct and indirect consolidated

subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Fiscal Year

The Company’s fiscal year ends on the last Tuesday in December. Each of the Company’s fiscal years ended

December 29, 2009 and December 25, 2007 had 52 weeks. The Company’s fiscal year ended December 30, 2008

had 53 weeks, with the fourth quarter comprising 14 weeks.

Adoption of the FASB Accounting Standards Codification

In June 2009, the Financial Accounting Standards Board (“FASB”) issued the FASB Accounting Standards

Codification (“ASC”). The ASC became the single source for all authoritative GAAP recognized by the FASB and

is required to be applied to financial statements issued for interim and annual periods ending after September 15,

2009. The ASC does not change GAAP and did not impact the Company’s consolidated financial statements.

Subsequent Events

The Company has evaluated the period from December 30, 2009 through February 26, 2010, the date the

financial statements herein were issued, for subsequent events requiring recognition or disclosure in the financial

statements. No material subsequent events were identified.

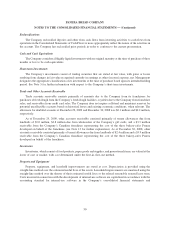

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates.

49