Panera Bread 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

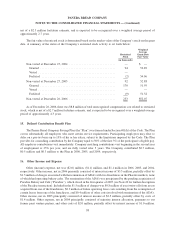

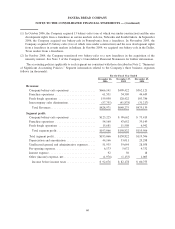

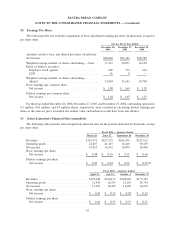

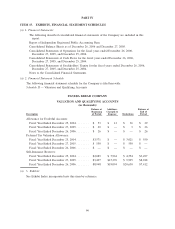

March 29 June 28 September 27 December 27

Fiscal 2005 — Quarters Ended (pro forma)(1)

Revenues ............................ 144,137 151,908 158,072 186,158

Operating profit ....................... 19,288 16,741 18,106 26,960

Net income .......................... 12,222 10,703 11,778 17,480

Basic earnings per share:

Net income ......................... $ 0.40 $ 0.35 $ 0.38 $ 0.56

Diluted earnings per share:

Net income ......................... $ 0.39 $ 0.34 $ 0.37 $ 0.55

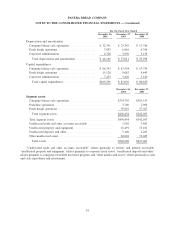

(1) In fiscal 2006, the Company adopted a new quarterly fiscal calendar whereby each of its quarters included

13 weeks (4 week, 5 week, and 4 week period progressions in each quarter), rather than its prior quarterly fiscal

calendar which had 16 weeks in the first quarter and 12 weeks in the second, third, and fourth quarters (4 week

period progressions in each quarter). Pro forma information above presents the fiscal 2005 quarterly financial

results as if the new quarterly calendar had been adopted for fiscal 2005. In addition, effective December 28,

2005, the beginning of the Company’s first quarter of 2006, the Company adopted the fair value recognition

provisions of SFAS 123R, which requires all stock-based compensation, including grants of employee stock

options, to be recognized in the statement of operations based on their fair values. The Company adopted this

accounting treatment using the modified prospective transition method, as permitted under SFAS 123R;

therefore results for prior periods have not been restated. Prior to the adoption of SFAS 123R, the Company

accounted for stock-based compensation using the intrinsic value method prescribed in Accounting Principles

Board Opinion No. 25, “Accounting for Stock Issued to Employees,” and related interpretations. Accordingly,

stock-based compensation was included as pro forma disclosure in the financial statement footnotes. Footnote

option expense would have decreased pro forma diluted earnings per share above for the first, second, third, and

fourth quarters by $0.03, $0.04, $0.03, and $0.03, respectively.

(2) The fourth quarter of 2006 diluted earnings per share of $0.59 includes a charge of $0.03 per diluted share

related to the Paradise acquisition.

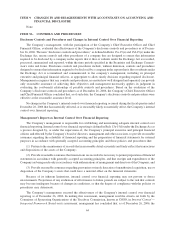

20. Subsequent Event

On February 1, 2007, the Company purchased 51 percent of the outstanding stock of Paradise, owner and

operator of 23 locations including 22 bakery-cafes, 17 of which are in the Phoenix market, and one commissary, and

franchisor of 23 locations including 22 bakery-cafes and one commissary, at a transaction value of $21.1 million.

Approximately $20.1 million of the acquisition price was paid with cash on hand at the time of closing with the

remaining approximately $1.0 million to be paid with interest in 2007. In addition, Panera Bread has the right to

purchase the remaining 49 percent of the outstanding stock of Paradise after January 1, 2009 at a contractually

determined value, which approximates fair value. Also, if Panera Bread has not exercised its right to purchase the

remaining 49 percent of the outstanding stock of Paradise, the remaining Paradise owners have the right to purchase

Panera Bread’s 51 percent ownership interest in Paradise after June 30, 2009 for $21.1 million. The Consolidated

Statements of Operations will include the Paradise results of operations from the date of the acquisition. The

Company will allocate the purchase price to the tangible and intangible assets acquired and liabilities assumed in

the acquisition at their estimated fair values with any remainder allocated to tax deductible goodwill.

63

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)