Panera Bread 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

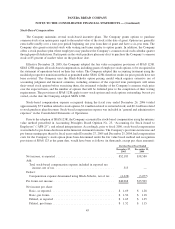

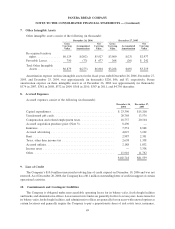

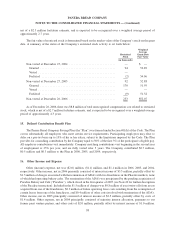

7. Other Intangible Assets

Other intangible assets consist of the following (in thousands):

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

December 26, 2006 December 27, 2005

Re-acquired territory

rights............... $6,129 $(202) $5,927 $3,000 $(23) $2,977

Favorable Leases ........ 750 (73) $ 677 268 (26) $ 242

Total Other Intangible

Assets .............. $6,879 $(275) $6,604 $3,268 $(49) $3,219

Amortization expense on these intangible assets for the fiscal years ended December 26, 2006, December 27,

2005, and December 25, 2004, was approximately (in thousands) $226, $46, and $3, respectively. Future

amortization expense on these intangible assets as of December 26, 2006 was approximately (in thousands):

$374 in 2007, $381 in 2008, $372 in 2009, $368 in 2010, $367 in 2011, and $4,756 thereafter.

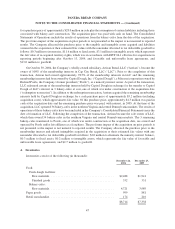

8. Accrued Expenses

Accrued expenses consist of the following (in thousands):

December 26,

2006

December 27,

2005

Capital expenditures ....................................... $ 23,396 $15,208

Unredeemed gift cards ..................................... 20,768 13,576

Compensation and related employment taxes..................... 18,757 20,104

Accrued acquisition purchase price (Note 3) ..................... 8,490 —

Insurance ............................................... 7,551 8,948

Accrued advertising ....................................... 4,027 3,102

Rent .................................................. 2,987 2,351

Taxes, other than income tax ................................ 2,638 1,338

Accrued utilities.......................................... 2,188 1,832

Income taxes ............................................ — 3,338

Other .................................................. 11,916 11,762

$102,718 $81,559

9. Line of Credit

The Company’s $10.0 million unsecured revolving line of credit expired on December 19, 2006 and was not

renewed. As of December 26, 2006, the Company has a $0.1 million outstanding letter of credit in support of certain

operational activities.

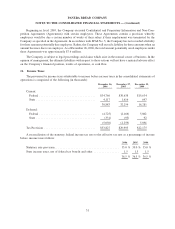

10. Commitments and Contingent Liabilities

The Company is obligated under non-cancelable operating leases for its bakery-cafes, fresh dough facilities

and trucks, and administrative offices. Lease terms for its trucks are generally for five to seven years. Lease terms for

its bakery-cafes, fresh dough facilities, and administrative offices are generally for ten years with renewal options at

certain locations and generally require the Company to pay a proportionate share of real estate taxes, insurance,

49

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)