Panera Bread 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

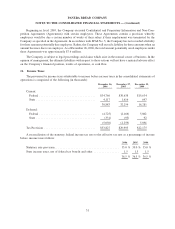

Beginning in fiscal 2003, the Company executed Confidential and Proprietary Information and Non-Com-

petition Agreements (Agreements) with certain employees. These Agreements contain a provision whereby

employees would be due a certain number of weeks of their salary if their employment was terminated by the

Company as specified in the Agreement. In accordance with SFAS No. 5, the Company has not recorded a liability

for these amounts potentially due employees. Rather, the Company will record a liability for these amounts when an

amount becomes due to an employee. As of December 26, 2006, the total amount potentially owed employees under

these Agreements was approximately $7.6 million.

The Company is subject to legal proceedings and claims which arise in the normal course of business. In the

opinion of management, the ultimate liabilities with respect to these actions will not have a material adverse effect

on the Company’s financial position, results of operations, or cash flow.

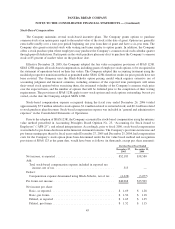

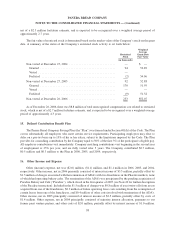

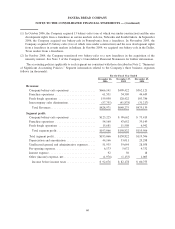

11. Income Taxes

The provision for income taxes attributable to income before income taxes in the consolidated statements of

operations is comprised of the following (in thousands):

December 26,

2006

December 27,

2005

December 25,

2004

Current:

Federal ................................... $34,766 $30,638 $15,634

State ..................................... 4,117 1,616 647

38,883 32,254 16,281

Deferred:

Federal ................................... (4,725) (2,166) 5,802

State ..................................... (331) (93) 92

(5,056) (2,259) 5,894

Tax Provision ................................ $33,827 $29,995 $22,175

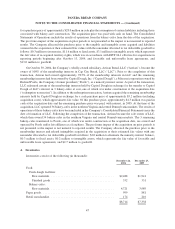

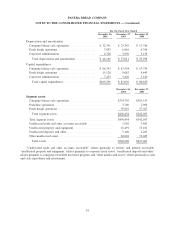

A reconciliation of the statutory federal income tax rate to the effective tax rate as a percentage of income

before income taxes follows:

2006 2005 2004

Statutory rate provision........................................ 35.0 % 35.0 % 35.0 %

State income taxes, net of federal tax benefit and other ................ 1.5 1.5 1.5

36.5 % 36.5 % 36.5 %

51

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)