Panera Bread 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

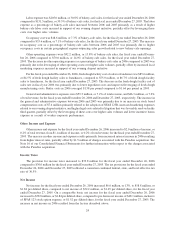

category of loss. We also purchase aggregate stop-loss and/or layers of loss insurance in many categories of loss. At

December 26, 2006 and December 27, 2005, self-insurance reserves were $7.4 million and $8.9 million, respec-

tively. We utilize third party actuarial experts’ estimates of expected losses based on statistical analyses of historical

industry data as well as our own estimates based on our actual historical data to determine required self-insurance

reserves. These assumptions are closely reviewed, monitored, and adjusted when warranted by changing circum-

stances. Actual experience related to number of claims and cost per claim could be more or less favorable than

estimated resulting in expense reduction or increase.

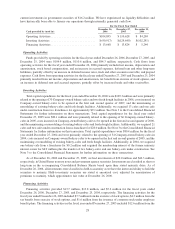

Lease Obligation

We recognize rent expense on a straight-line basis over the reasonably assured lease period. Certain of our

lease agreements provide for scheduled rent increases during the lease terms or for rental payments commencing at

a date other than the date of initial occupancy. We include any rent escalations and construction and other rent

holidays in our straight-line rent expense. In addition, we record landlord allowances for normal tenant improve-

ments as deferred rent, which is included in accrued expenses or deferred rent in the consolidated balance sheets

based on their short-term or long-term nature. These landlord allowances are amortized over the reasonably assured

lease term as a reduction of rent expense. Also, leasehold improvements are amortized using the straight-line

method over the shorter of their estimated useful lives or the related reasonably assured lease term. See Note 2 to the

Consolidated Financial Statements for further information on our accounting for leases.

Stock-Based Compensation

We maintain several stock-based incentive plans. We grant options to purchase common stock at an option

price equal to the market value of the stock at the date of grant. Options generally vest ratably over a four-year

period beginning two years from date of grant and have a six-year term. We also grant restricted stock with vesting

and terms similar to option grants. In addition, we offer a stock purchase plan where employees may purchase our

common stock each calendar quarter through payroll deductions. Participants in the stock purchase plan may elect

to purchase our common stock at 85 percent of market value on the purchase date and we recognize compensation

expense on the 15 percent discount.

Prior to the effective date of SFAS 123R, we applied APB No. 25, and related interpretations, for our stock

option grants. APB No. 25 provides that the compensation expense relative to our stock options is measured based

on the intrinsic value of the stock option at date of grant.

Effective the beginning of the first quarter of fiscal year 2006, we adopted the provisions of SFAS 123R using

the modified prospective transition method. Under this method, prior periods are not restated. We use the Black-

Scholes option pricing model which requires extensive use of accounting judgment and financial estimates,

including estimates of the expected term participants will retain their vested stock options before exercising them,

the estimated volatility of our common stock price over the expected term, and the number of options that will be

forfeited prior to the completion of their vesting requirements. Application of alternative assumptions could

produce significantly different estimates of the fair value of stock-based compensation and consequently, the related

amount of stock-based compensation expense recognized in the Consolidated Statements of Operations. The

provisions of SFAS 123R apply to new stock options and stock options outstanding, but not yet vested, on the date

we adopted SFAS 123R.

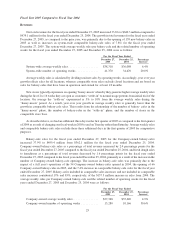

Stock-based compensation expense recognized during the fiscal year ended December 26, 2006 totaled

approximately $5.9 million related to stock options, $1.4 million related to restricted stock, and $0.3 million related

to stock purchase plan discounts. Stock-based compensation expense was included in “general and administrative

expenses” in the Consolidated Statements of Operations.

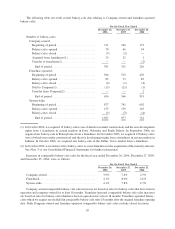

Contractual Obligations and Other Commitments

We currently anticipate total capital expenditures for fiscal year 2007 of approximately $115 million to

$130 million, which consists of the following: $82 million to $92 million related to the opening of at least 85 new

Company-owned bakery-cafes and the costs incurred on early 2008 openings, $16 million to $19 million related to

the remodeling of existing bakery-cafes, $7 million to $8 million related to the opening of new fresh dough facilities

30