Panera Bread 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

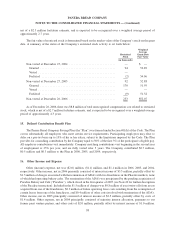

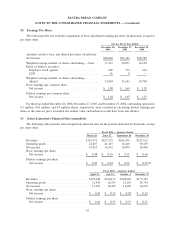

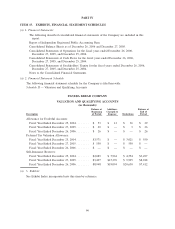

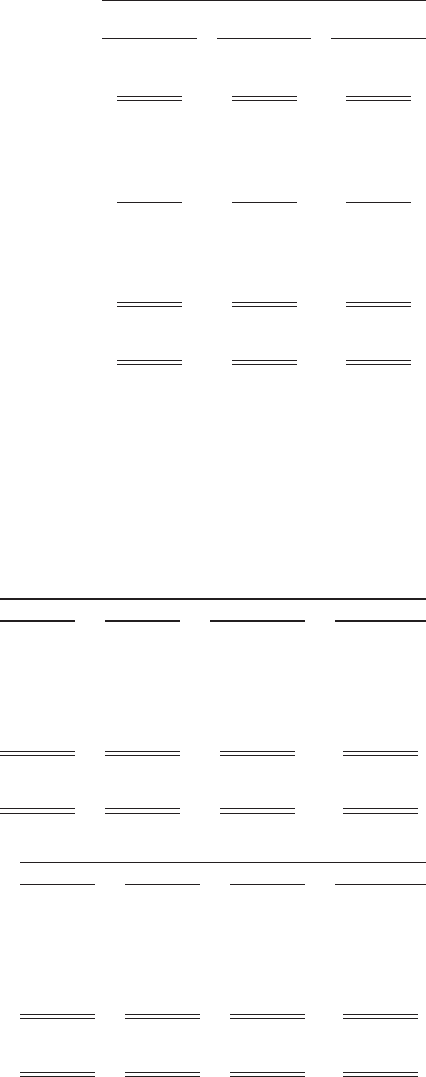

18. Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share (in thousands, except for

per share data):

December 26,

2006

December 27,

2005

December 25,

2004

For the Fiscal Year Ended

Amounts used for basic and diluted per share calculations:

Net income .................................... $58,849 $52,183 $38,580

Weighted average number of shares outstanding — basic . . 31,313 30,871 30,154

Effect of dilutive securities:

Employee stock options . ........................ 690 772 614

LTIP....................................... 41 8 —

Weighted average number of shares outstanding —

diluted ..................................... 32,044 31,651 30,768

Basic earnings per common share:

Net income .................................. $ 1.88 $ 1.69 $ 1.28

Diluted earnings per common share:

Net income .................................. $ 1.84 $ 1.65 $ 1.25

For the years ended December 26, 2006, December 27, 2005, and December 25, 2004, outstanding options for

0.3 million, 0.03 million, and 0.5 million shares, respectively, were excluded in calculating diluted earnings per

share as the exercise price exceeded fair market value and inclusion would have been anti-dilutive.

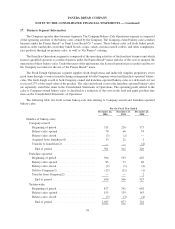

19. Selected Quarterly Financial Data (unaudited)

The following table presents selected quarterly financial data for the periods indicated (in thousands, except

per share data):

March 28 June 27 September 26 December 26

Fiscal 2006 — Quarters Ended

Revenues ............................ $193,971 $197,135 $204,954 $232,912

Operating profit ....................... 22,667 21,415 16,240 30,470

Net income .......................... 15,013 14,052 10,879 18,906

Basic earnings per share:

Net income ......................... $ 0.48 $ 0.45 $ 0.35 $ 0.60

Diluted earnings per share:

Net income ......................... $ 0.47 $ 0.44 $ 0.34 $ 0.59(2)

April 19 July 12 October 4 December 27

Fiscal 2005 — Quarters Ended

Revenues .............................. $178,148 $140,172 $148,626 $173,329

Operating profit ......................... 21,942 16,275 18,124 24,754

Net income ............................ 13,923 10,429 11,669 16,162

Basic earnings per share:

Net income .......................... $ 0.45 $ 0.34 $ 0.38 $ 0.52

Diluted earnings per share:

Net income .......................... $ 0.44 $ 0.33 $ 0.37 $ 0.51

62

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)