Panera Bread 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

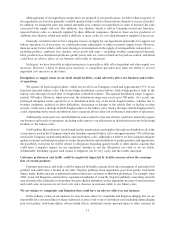

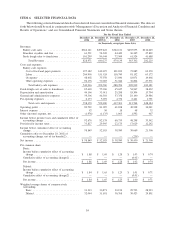

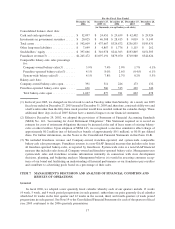

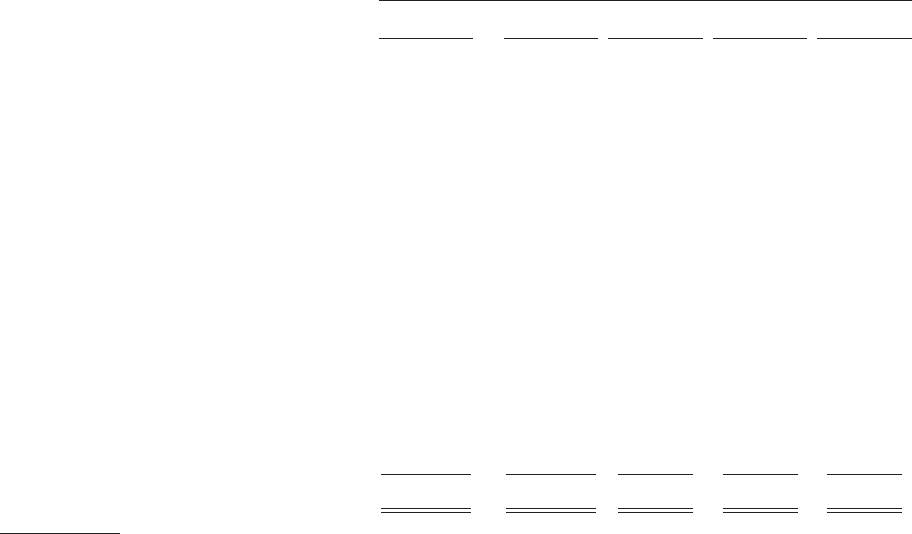

December 26,

2006

December 27,

2005 (1)

December 25,

2004

December 27,

2003

December 28,

2002

For the Fiscal Year Ended

(in thousands, except bakery-cafe data)

Consolidated balance sheet data:

Cash and cash equivalents .............. $ 52,097 $ 24,451 $ 29,639 $ 42,402 $ 29,924

Investments in government securities ...... $ 20,025 $ 46,308 $ 28,415 $ 9,019 $ 9,149

Total assets ......................... $ 542,609 $ 437,667 $324,672 $256,835 $195,431

Other long-term liabilities .............. $ 7,649 $ 4,867 $ 1,776 $ 1,115 $ 262

Stockholders’ equity .................. $ 397,666 $ 316,978 $241,363 $193,805 $151,503

Franchisee revenue(3) ................. $1,245,472 $1,097,191 $879,070 $710,980 $542,624

Comparable bakery-cafe sales percentage

for:

Company-owned bakery-cafes(3) ....... 3.9% 7.4% 2.9% 1.7% 4.1%

Franchise-operated bakery-cafes(3) ...... 4.1% 8.0% 2.6% (0.4)% 6.1%

System-wide bakery-cafes(3) .......... 4.1% 7.8% 2.7% 0.2% 5.5%

Bakery-cafe data:

Company-owned bakery-cafes open ....... 391 311 226 173 132

Franchise-operated bakery-cafes open ..... 636 566 515 429 346

Total bakery-cafes open .............. 1,027 877 741 602 478

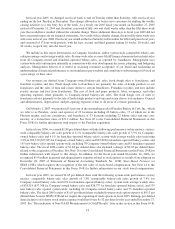

(1) In fiscal year 2005, we changed our fiscal week to end on Tuesday rather than Saturday. As a result, our 2005

fiscal year ended on December 27, 2005 instead of December 31, 2005 and, therefore, consisted of fifty-two and

a half weeks rather than the fifty-three week year that would have resulted without the calendar change. These

additional three days in fiscal 2005 did not have a material impact on our financial statements.

(2) Effective December 29, 2002, we adopted the provisions of Statement of Financial Accounting Standards

(SFAS) No. 143, “Accounting for Asset Retirement Obligations.” This Statement required us to record an

estimate for costs of retirement obligations that may be incurred at the end of lease terms of existing bakery-

cafes or other facilities. Upon adoption of SFAS 143, we recognized a one-time cumulative effect charge of

approximately $0.2 million (net of deferred tax benefit of approximately $0.1 million), or $0.01 per diluted

share. For further information, see the Notes to the Consolidated Financial Statements in this Form 10-K.

(3) We included franchisee revenue and Company-owned, franchise-operated, and system-wide comparable

bakery-cafe sales percentages. Franchisee revenue is a non-GAAP financial measure that includes sales from

all franchise-operated bakery-cafes, as reported by franchisees. System-wide sales is a non-GAAP financial

measure that includes sales from all Company-owned and franchise-operated bakery-cafes. Management uses

system-wide sales and franchisee revenue information internally in connection with store development

decisions, planning, and budgeting analyses. Management believes it is useful in assessing consumer accep-

tance of our brand and facilitating an understanding of financial performance as our franchisees pay royalties

and contribute to advertising pools based on a percentage of their sales.

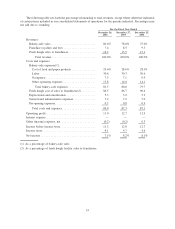

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

General

In fiscal 2006, we adopted a new quarterly fiscal calendar whereby each of our quarters include 13 weeks

(4 week, 5 week, and 4 week period progressions in each quarter), rather than our prior quarterly fiscal calendar

which had 16 weeks in the first quarter and 12 weeks in the second, third, and fourth quarters (4 week period

progressions in each quarter). See Note 19 to the Consolidated Financial Statements for each of the quarters of fiscal

year 2005 conformed to the 2006 quarterly presentation.

17