Panera Bread 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Retirement Obligations

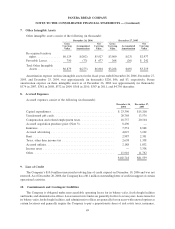

The Company recognizes the future cost to comply with lease obligations at the end of a lease as it relates to

tangible long-lived assets in accordance with the provisions of SFAS No. 143, “Accounting for Asset Retirement

Obligations” (“SFAS 143”), as interpreted by Financial Accounting Standards Board (“FASB”) Interpretation

No. 47, “Accounting for Conditional Asset Retirement Obligations” (“FIN 47”). A liability for the fair value of an

asset retirement obligation along with a corresponding increase to the carrying value of the related long-lived asset

is recorded at the time a lease agreement is executed. The Company amortizes the amount added to property and

equipment and recognizes accretion expense in connection with the discounted liability over the life of the

respective lease. The estimated liability is based on experience in closing bakery-cafes and the related external cost

associated with these activities. Revisions to the liability could occur due to changes in estimated retirement costs or

changes in lease term.

Recently Issued Pronouncements

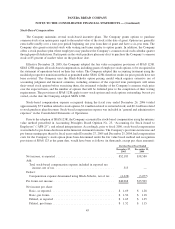

In June 2006, the Financial Accounting Standards Board issued FASB Interpretation No. 48, Accounting for

Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109, or FIN 48. FIN 48 clarifies the

accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with

FASB Statement No. 109, Accounting for Income Taxes. FIN 48 prescribes a recognition threshold and measure-

ment attribute for the financial statement recognition and measurement of a tax position taken or expected to be

taken in a tax return. This pronouncement also provides guidance on derecognition, classification, interest and

penalties, accounting in interim periods, disclosure, and transition. FIN 48 is effective for fiscal years beginning

after December 15, 2006; therefore, the Company will adopt the new requirements for fiscal 2007. The Company is

evaluating the effect of this pronouncement on its consolidated financial statements.

3. Acquisitions

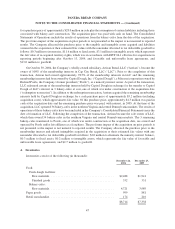

On October 24, 2006, the Company purchased substantially all of the assets of thirteen bakery-cafes (one of

which was under construction) and the area development rights for certain markets in Iowa, Nebraska and

South Dakota from its area developer, Panebraska, L.L.C., for a purchase price of approximately $15.3 million in

cash plus approximately $0.1 million in acquisition costs. Approximately $6.9 million of the acquisition price was

paid with cash on hand at the time of closing with the remaining approximately $8.4 million to be paid with interest

in 2007. The Consolidated Statements of Operations include the results of operations from the operating bakery-

cafes from the date of the acquisition. The pro forma impact of the acquisition on prior periods is not presented, as

the impact is not material to reported results. The Company allocated the purchase price to the tangible and

intangible assets acquired and liabilities assumed in the acquisition at their estimated fair values with the remainder

allocated to tax deductible goodwill as follows: $0.2 million to inventories, $4.8 million to fixed assets, $3.5 million

to intangible assets, which represents the fair value of re-acquired territory rights and favorable and unfavorable

lease agreements, and $6.9 million to goodwill.

On September 27, 2006, the Company purchased from a franchisee substantially all of the assets of one bakery-

cafe for a cash purchase price of $2.4 million. Approximately $2.1 million of the acquisition price was paid with

cash on hand at the time of closing with the remaining approximately $0.3 million to be paid with interest in 2007.

The Consolidated Statements of Operations include the results of operations of the one bakery-cafe from the date of

acquisition. The pro forma impact of the acquisition on prior periods is not presented, as the impact is not material to

reported results. The Company allocated the purchase price to the tangible and intangible assets acquired in the

acquisition at their estimated fair values with the remainder allocated to tax deductible goodwill as follows:

$0.6 million to fixed assets, $0.1 million to intangible assets, which represents the fair value of a re-acquired

territory right and a favorable lease agreement, and $1.7 million to goodwill.

On November 1, 2005, the Company purchased from a franchisee substantially all of the assets of twenty-three

bakery-cafes (two of which were under construction) and the area development rights for certain markets in Indiana

46

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)