Panera Bread 2006 Annual Report Download - page 58

Download and view the complete annual report

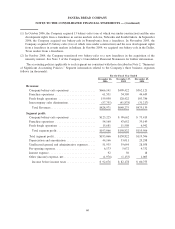

Please find page 58 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Company through payment of death benefits and mortality dividends received. Interest expense is recorded on

the accrual basis.

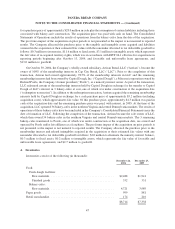

13. Stockholders’ Equity

Common Stock

The holders of Class A Common Stock are entitled to one vote for each share owned. The holders of Class B

Common Stock are entitled to three votes for each share owned. Each share of Class B Common Stock has the same

dividend and liquidation rights as each share of Class A Common Stock. Each share of Class B Common Stock is

convertible, at the stockholder’s option, into Class A Common Stock on a one-for-one basis. At December 26, 2006,

the Company had reserved 4,638,635 shares of its Class A Common Stock for issuance upon exercise of awards

granted under the Company’s 1992 Equity Incentive Plan, Formula Stock Option Plan for Independent Directors,

2001 Employee, Director, and Consultant Stock Option Plan, and the 2006 Stock Incentive Plan, and upon

conversion of Class B Common Stock.

Registration Rights

At December 26, 2006, over 90% of the Class B Common Stock is owned by the Company’s Chairman and

Chief Executive Officer (“CEO”). Certain holders of Class B Common Stock, including the Company’s CEO,

pursuant to stock subscription agreements, can require the Company under certain circumstances to register their

shares under the Securities Exchange Act of 1933, or have included in certain registrations all or part of such shares

at the Company’s expense.

Preferred Stock

The Company is authorized to issue 2,000,000 shares of Class B Preferred Stock with a par value of $.0001.

The voting, redemption, dividend, liquidation rights, and other terms and conditions are determined by the Board of

Directors upon approval of issuance. There were no shares issued or outstanding in 2006 and 2005.

Treasury Stock

In the third quarter of 2000, the Company repurchased 109,000 shares of Class A Common Stock at an average

cost of $8.25 per share.

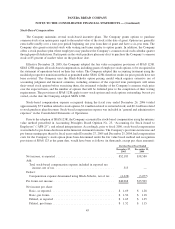

14. Stock-Based Compensation

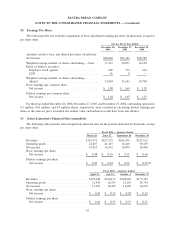

Effective December 28, 2005, the Company adopted the fair value recognition provisions of SFAS 123R.

SFAS 123R requires all stock-based compensation, including grants of employee stock options, to be recognized in

the statement of operations based on their fair values. The Company adopted this accounting treatment using the

modified prospective transition method, as permitted under SFAS 123R; therefore results for prior periods have not

been restated. The Company uses the Black-Scholes option pricing model which requires extensive use of

accounting judgment and financial estimates, including estimates of the expected term participants will retain

their vested stock options before exercising them, the estimated volatility of the Company’s common stock price

over the expected term, and the number of options that will be forfeited prior to the completion of their vesting

requirements. The provisions of SFAS 123R apply to new stock options and stock options outstanding, but not yet

vested, on the date of the Company adopted SFAS 123R.

As a result of adopting SFAS 123R on December 28, 2005, stock-based compensation expense related to stock

options was $5.9 million, or $0.18 per diluted share, which is net of $0.7 million of capitalized compensation cost related

to new bakery-cafe construction. The income tax benefit recognized for stock option expense was $2.2 million. Cash

received from the exercise of stock options in 2006 and 2005 was $7.7 million and $12.6 million, respectively. Windfall

tax benefits realized from exercised stock options in 2006 and 2005 was $4.3 million and $9.3 million, respectively.

53

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)