Panera Bread 2006 Annual Report Download - page 32

Download and view the complete annual report

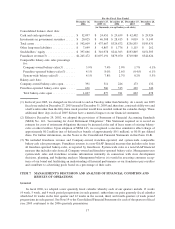

Please find page 32 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expense as a percentage of bakery-cafe sales decreased between the fiscal year ended December 27, 2005 and the

fiscal year ended December 25, 2004 primarily as a result of leveraging these costs over higher sales volumes,

partially offset by higher costs in the bakery-cafe bonus program.

For the fiscal year ended December 27, 2005, fresh dough facility cost of sales to franchisees was $75.0 million,

or 86.7% of fresh dough facility sales to franchisees, compared to $65.6 million, or 90.4% of fresh dough facility

sales to franchisees, for the fiscal year ended December 25, 2004. The decrease in the fresh dough facility cost of

sales rate in fiscal year 2005 was primarily due to lower ingredient costs. Butter costs in 2005 averaged $1.64 per

pound compared to $1.94 per pound in 2004.

General and administrative expenses were $46.3 million, or 7.2% of total revenue, and $33.3 million, or 7.0%

of total revenue, for the fiscal years ended December 27, 2005 and December 25, 2004, respectively. The increase in

the general and administrative expense rate between 2005 and 2004 was primarily the result of increased incentive

compensation and marketing costs partially offset by the improved leveraging of these costs over higher revenue.

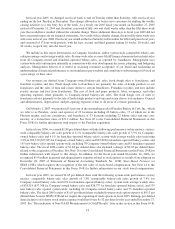

Other Income and Expense

Other income and expense for the fiscal year ended December 27, 2005 increased to $1.1 million of income, or

0.2% of total revenue, from $1.1 million of expense, or 0.3% of total revenue, for the fiscal year ended December 25,

2004. The increase in other income and expense results primarily from increased interest income in 2005 resulting

from both higher investment balances and higher interest rates.

Income Taxes

The provision for income taxes increased to $30.0 million for the fiscal year ended December 27, 2005

compared to $22.2 million for the fiscal year ended December 25, 2004. The tax provisions for the fiscal year ended

December 27, 2005 and December 25, 2004 reflected a consistent combined federal, state, and local effective tax

rate of 36.5%.

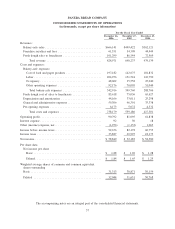

Net Income

Net income for the fiscal year ended December 27, 2005 increased $13.6 million, or 35%, to $52.2 million, or

$1.65 per diluted share, compared to net income of $38.6 million, or $1.25 per diluted share, for the fiscal year

ended December 25, 2004. The increase in net income in 2005 resulted from the factors described above.

Liquidity and Capital Resources

Cash and cash equivalents were $52.1 million at December 26, 2006, compared with $24.5 million at

December 27, 2005. Our principal requirements for cash are capital expenditures for the development of new

Company-owned bakery-cafes, maintaining or remodeling existing Company-owned bakery-cafes, purchasing

existing franchise-operated bakery-cafes, developing, remodeling and maintaining fresh dough facilities, and for

enhancements of information systems and other infrastructure capital investments. See Note 3 of our Consolidated

Financial Statements for acquisitions of franchise-operated bakery-cafes during 2006. For the fiscal year ended

December 26, 2006, we met our requirements for capital with cash from operations.

We had net working capital of $18.0 million at December 26, 2006 and $15.9 million at December 27, 2005.

The increase in working capital from December 27, 2005 to December 26, 2006 resulted primarily from an increase

in cash of $27.6 million, an increase in prepaid expenses of $6.3 million, and an increase in trade and other accounts

receivable of $5.8 million, partially offset by an increase in accrued expenses of $21.2 million and a decrease in

27