Panera Bread 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

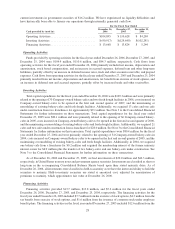

exercise of stock options and $1.2 million from the issuance of common stock under employee benefit plans. The

financing activities for the fiscal year ended December 25, 2004 primarily included $3.6 million from the exercise

of stock options and $1.1 million from the issuance of common stock under employee benefit plans.

We had a $10.0 million unsecured revolving line of credit that expired on December 19, 2006 and was not

renewed. As of December 26, 2006, we had a $0.1 million outstanding letter of credit in support of certain

operational activities.

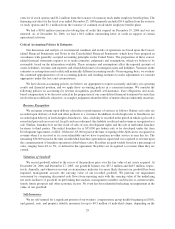

Critical Accounting Policies & Estimates

Our discussion and analysis of our financial condition and results of operations are based upon the Consol-

idated Financial Statements and Notes to the Consolidated Financial Statements, which have been prepared in

accordance with generally accepted accounting principles in the United States. The preparation of these consol-

idated financial statements requires us to make estimates, judgments and assumptions, which we believe to be

reasonable, based on the information available. These estimates and assumptions affect the reported amounts of

assets, liabilities, revenues and expenses and related disclosures of contingent assets and liabilities. Variances in the

estimates or assumptions used could yield materially different accounting results. On an ongoing basis, we evaluate

the continued appropriateness of our accounting policies and resulting estimates to make adjustments we consider

appropriate under the facts and circumstances.

We have chosen accounting policies we believe are appropriate to report accurately and fairly our operating

results and financial position, and we apply those accounting policies in a consistent manner. We consider the

following policies on accounting for revenue recognition, goodwill, self-insurance, lease obligations, and stock-

based compensation to be the most critical in the preparation of our consolidated financial statements because they

involve the most difficult, subjective, or complex judgments about the effect of matters that are inherently uncertain.

Revenue Recognition

We recognize revenue upon delivery of product or performance of services as follows. Bakery-cafe sales are

recorded upon delivery of food and other products to a customer. In addition, fresh dough sales to franchisees are

recorded upon delivery of fresh dough to franchisees. Also, a liability is recorded in the period in which a gift card is

issued and proceeds are received. As gift cards are redeemed, this liability is reduced and revenue is recognized as a

sale. Further, franchise fees are the result of sales of area development rights and the sale of individual franchise

locations to third parties. The initial franchise fee is $35,000 per bakery-cafe to be developed under the Area

Development Agreement, or ADA. Of this fee, $5,000 is paid at the time of signing of the ADA and is recognized as

revenue when it is received as it is non-refundable and we have to perform no other service to earn this fee. The

remaining $30,000 is paid at the time an individual franchise agreement is signed and is recognized as revenue upon

the commencement of franchise operations of the bakery-cafes. Royalties are paid weekly based on a percentage of

sales, ranging from 4% to 5%, as defined in the agreement. Royalties are recognized as revenue when they are

earned.

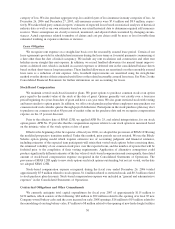

Valuation of Goodwill

We record goodwill related to the excess of the purchase price over the fair value of net assets acquired. At

December 26, 2006 and December 27, 2005, our goodwill balance was $57.2 million and $48.5 million, respec-

tively. Annually, and whenever an event or circumstance indicates it is more likely than not our goodwill has been

impaired, management assesses the carrying value of our recorded goodwill. We perform our impairment

assessment by comparing discounted cash flows from reporting units with the carrying value of the underlying

net assets inclusive of goodwill. In performing this analysis, management considers such factors as current results,

trends, future prospects and other economic factors. No event has been identified indicating an impairment in the

value of our goodwill.

Self-Insurance

We are self-insured for a significant portion of our workers’ compensation, group health (beginning in 2005),

and general, auto, and property liability insurance for up to $0.5 million of individual claims, depending on the

29