Panera Bread 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

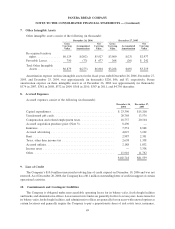

net of a $2.3 million forfeiture estimate, and is expected to be recognized over a weighted average period of

approximately 2.7 years.

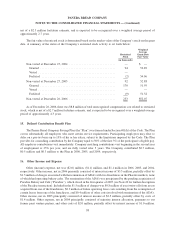

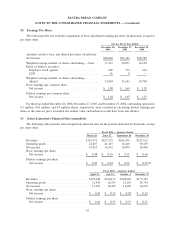

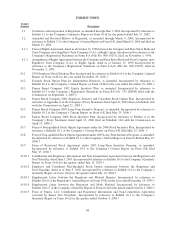

The fair value of restricted stock is determined based on the market value of the Company’s stock on the grant

date. A summary of the status of the Company’s restricted stock activity is set forth below:

Restricted

Stock

Weighted

Average

Grant-Date

Fair Value

(in thousands)

Non-vested at December 25, 2004 ............................. — $ —

Granted ............................................... 94 52.89

Vested ................................................ —

Forfeited .............................................. (2) 54.06

Non-vested at December 27, 2005 ............................. 92 52.88

Granted ............................................... 170 51.59

Vested ................................................ — —

Forfeited .............................................. (9) 51.32

Non-vested at December 26, 2006 ............................. 253 $52.07

As of December 26, 2006, there was $8.8 million of total unrecognized compensation cost related to restricted

stock, which is net of a $2.7 million forfeiture estimate, and is expected to be recognized over a weighted-average

period of approximately 4.3 years.

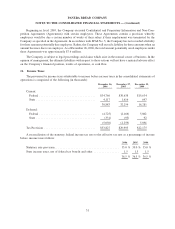

15. Defined Contribution Benefit Plan

The Panera Bread Company Savings Plan (the “Plan”) was formed under Section 401(k) of the Code. The Plan

covers substantially all employees who meet certain service requirements. Participating employees may elect to

defer on a pre-tax basis up to 15% of his or her salary, subject to the limitations imposed by the Code. The Plan

provides for a matching contribution by the Company equal to 50% of the first 3% of the participant’s eligible pay.

All employee contributions vest immediately. Company matching contributions vest beginning in the second year

of employment at 25% per year, and are fully vested after 5 years. The Company contributed $0.7 million,

$0.5 million and $0.3 million to the Plan in 2006, 2005, and 2004, respectively.

16. Other Income and Expense

Other (income) expense, net was ($2.0) million, ($1.1) million, and $1.1 million in 2006, 2005, and 2004,

respectively. Other income, net in 2006 primarily consisted of interest income of $3.5 million, partially offset by

$1.5 million of charges associated with the termination of ADA’s with two franchisees in the Phoenix markets, none

of which had operating bakery-cafes. The termination of the ADA’s was precipitated by the pending acquisition of

Paradise Bakery and Café (“Paradise”), which closed in the first quarter of 2007 (see Note 20 for further description

of the Paradise transaction). Included in the $1.5 million of charges was $0.8 million of asset write-offs from assets

acquired from one of the franchisees, $0.3 million of future operating lease costs resulting from the assumption of

certain leases from one of the franchisees, and $0.4 million of other costs involved with termination of the ADA’s.

Other income, net in 2005 principally consisted of interest income of $2.5 million, partially offset by costs of

$1.4 million. Other expense, net in 2004 principally consisted of minority interest allocation, payments to our

former joint venture partner, and other costs of $2.0 million, partially offset by interest income of $1.0 million.

58

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)