Panera Bread 2006 Annual Report Download - page 49

Download and view the complete annual report

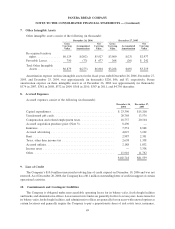

Please find page 49 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.construction period and other rent holidays in its determination of straight-line rent expense. Therefore, rent

expense for new locations is charged to expense beginning with the start of the construction period.

The Company records landlord allowances related to non-structural building improvements as deferred rent,

which is included in accrued expenses or deferred rent in the consolidated balance sheets based on their short-term

or long-term nature. This deferred rent is amortized over the reasonably assured lease term as a reduction of rent

expense.

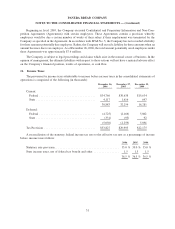

Fiscal Year

In fiscal 2006, the Company adopted a new quarterly calendar whereby each of its quarters includes 13 weeks

(4 week, 5 week, and 4 week period progressions in each quarter). In 2005, the Company changed its fiscal week to

end on Tuesday rather than Saturday, with our fiscal year ending on the last Tuesday in December. As a result, the

Company’s 2005 fiscal year ended on December 27, 2005 and consisted of fifty-two and a half weeks rather than the

fifty-three week year that would have resulted without the calendar change. The additional days in fiscal 2005

occurred in the first quarter, resulting in the first quarter being sixteen and a half weeks. The additional three days in

the first quarter of 2005 did not have a material impact on the Company’s financial statements. The Company’s

fiscal year ended on the last Saturday in December for 2004 and prior fiscal years and consisted of 13 four-week

periods, with the first, second, and third quarters ending 16 weeks, 28 weeks, and 40 weeks, respectively, into the

fiscal year.

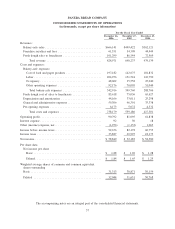

Earnings Per Share Data

Earnings per share is based on the weighted average number of shares outstanding during the period after

consideration of the dilutive effect, if any, for common stock equivalents, including stock options, restricted stock,

and other stock-based compensation. Earnings per common share are computed in accordance with SFAS No. 128,

“Earnings Per Share,” which requires companies to present basic earnings per share and diluted earnings per share.

Basic earnings per share are computed by dividing net income by the weighted average number of shares of

common stock outstanding during the year. Diluted earnings per common share are computed by dividing net

income by the weighted average number of shares of common stock outstanding and dilutive securities outstanding

during the year.

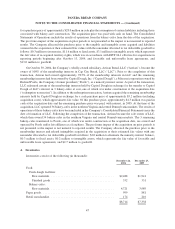

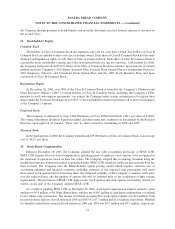

Fair Value of Financial Instruments

The carrying amount of the Company’s accounts receivable and accounts payable approximate their fair values

due to the short-term maturity of these instruments. In addition, held-to-maturity securities are stated at amortized

cost, adjusted for amortization of premiums to maturity using the effective interest method, which approximates fair

value at December 26, 2006.

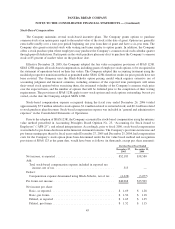

Derivative Financial Instruments

The Company periodically enters into swap agreements to manage fluctuating butter prices. Swap agreements

designated at inception as a hedge are accounted for under the deferral method, with gains and losses from hedging

activity included in the cost of sales as those inventories are sold or as the anticipated hedge transaction occurs.

Swap agreements not designated as effective hedges of firm commitments or anticipated underlying transactions are

marked to market at the end of the reporting period, with the resulting gains or losses recognized in cost of sales. The

Company does not invest in derivative financial instruments for trading purposes.

At December 26, 2006, the Company did not have any derivative financial instruments.

44

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)