Panera Bread 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

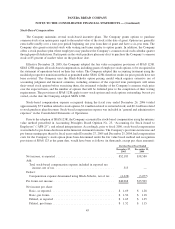

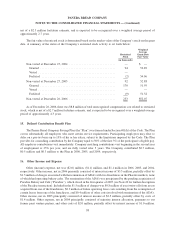

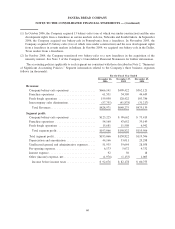

The tax effects of the significant temporary differences which comprise the deferred tax assets and liabilities

are as follows (in thousands):

December 26,

2006

December 27,

2005

Deferred tax assets:

Accrued expenses ....................................... $16,239 $ 13,681

Share-based compensation ................................ 2,531 368

Other ................................................ 143 9

Total deferred tax assets ................................ $18,913 $ 14,058

Deferred tax liabilities:

Property, plant, and equipment ............................. $ (7,554) $ (9,658)

Goodwill ............................................. (7,080) (5,551)

Other ................................................ (365) —

Total deferred tax liabilities .............................. $(14,999) $(15,209)

Net deferred tax asset (liability) .............................. $ 3,914 $ (1,151)

Net current deferred tax asset ................................ $ 3,827 $ 3,871

Net non-current deferred tax asset (liability) ..................... $ 87 $ (5,022)

12. Deposits and Other

The Company established a company-owned life insurance (“COLI”) program covering a substantial portion

of its employees to help manage long-term employee benefit cost and to obtain tax deductions on interest payments

on insurance policy loans. However, due to tax law changes, the Company froze this program in 1998. It appears

based on actuarial estimates that the program will end in 2013.

At December 26, 2006 and December 27, 2005, the cash surrender values of $4.2 million and $5.3 million,

respectively, the mortality income receivables of $1.9 million and $2.3 million, respectively, and the insurance

policy loans of $4.2 million and $5.3 million, respectively, related to the COLI program were netted and included in

other assets in the Company’s consolidated balance sheets. Mortality income receivable represents the dividend or

death benefits the Company is due from its insurance carrier at the respective dates. The insurance policy loans are

collateralized by the cash values of the underlying life insurance policies and require interest payments at a rate of

7.7% for the year ended December 26, 2006. Interest accrued on insurance policy loans is netted with other COLI

related income statement transactions in other income (expense) in the consolidated statements of operations, which

netted ($0.1) million, ($0.2) million, and ($0.1) million in 2006, 2005, and 2004, respectively, the components of

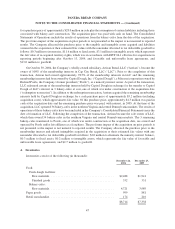

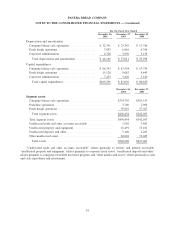

which are as follows (in thousands):

2006 2005 2004

Cash value loss ........................................ $(1,103) $(2,049) $(2,103)

Mortality income ....................................... 1,323 2,332 2,561

Interest expense........................................ (368) (479) (584)

Expense ............................................. $ (148) $ (196) $ (126)

The cash value loss is the cumulative change in cash surrender value for the year and is adjusted quarterly.

Mortality income is recorded periodically as charges are deducted from cash value. These amounts are recovered by

52

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)