Panera Bread 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.addition, we are subject to litigation by employees, franchisees and others through private actions, class actions or other

forums. The outcome of litigation is difficult to assess and quantify and the defense against such claims or actions can be

costly. In addition to decreasing sales and profitability and diverting financial and management resources, we may suffer

from adverse publicity that could harm our brand, regardless of whether the allegations are valid or whether we are liable.

In fact, we are subject to the same risks of adverse publicity resulting from allegations even if the claim involves one of

our franchisees. A judgment significantly in excess of our insurance coverage for any claims could materially and

adversely affect our financial condition or results of operations. Additionally, publicity about these claims may harm our

reputation or prospects and adversely affect our results.

We are subject to periodic new accounting pronouncements that could have a material adverse impact

on our profitability or results of operations.

New accounting pronouncements are periodically issued which could change our current accounting practices. We

assess each new pronouncement for applicability and potential impact. Depending on whether the applicable pronounce-

ment is to be retroactively implemented or prospectively implemented, and depending on the magnitude of the change,

implementation could have a significant adverse impact on historical or future profitability or results of operations.

We periodically acquire existing bakery-cafes from our franchisees, or ownership interests in other res-

taurant or bakery-cafe concepts, which could adversely affect our results of operations.

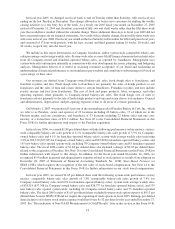

We have historically acquired existing bakery-cafes and development rights from our franchisees either by

negotiated agreement or exercise of our rights of first refusal under the franchise and area development agreements.

For example, in fiscal year 2006, we acquired 14 bakery-cafes from franchisees (including one under construction).

In addition, on February 1, 2007, we purchased 51% of the outstanding stock of Paradise Bakery & Café, Inc.,

which we refer to as Paradise, owner and operator of 23 locations including 22 bakery-cafes, 17 of which are in the

Phoenix market, and one commissary, and franchisor of 23 locations including 22 bakery-cafes and one com-

missary. Any acquisition that we undertake involves risk, including:

• our ability to successfully achieve anticipated synergies, accurately assess contingent and other liabilities as

well as potential profitability;

• unanticipated changes in business and economic conditions;

• limited or no operational experience in the acquired bakery-cafe market or other restaurant concept;

• future impairment charges related to goodwill and other acquired intangible assets; and

• risks of dispute and litigation with the seller, the seller’s landlords, and vendors and other parties.

Any of these factors could strain our financial and management resources as well as negatively impact our

results of operation.

Our operating results fluctuate due to a number of factors, some of which may be beyond our control,

and any of which may adversely affect our financial condition.

Our quarterly operating results may fluctuate significantly because of a number of factors, including the

following, some of which are not within our control:

• changes in our operating costs;

• labor availability and wages of management and associates;

• increases and decreases in average weekly sales and comparable bakery-cafe sales, including as a result of

the introduction of new menu items;

• profitability of new bakery-cafes, especially in new markets;

• changes in demographics, consumer preferences and discretionary spending;

• changes in business strategy including concept evolution and new designs;

12