Panera Bread 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

current investments in government securities of $16.2 million. We have experienced no liquidity difficulties and

have historically been able to finance our operations through internally generated cash flow.

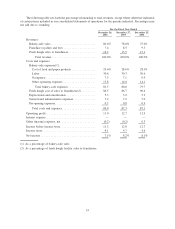

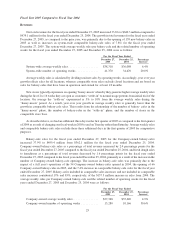

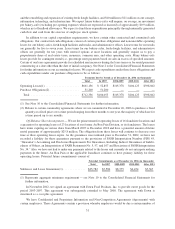

Cash provided by (used in):

December 26,

2006

December 27,

2005

December 25,

2004

For the Fiscal Year Ended

Operating Activities............................ $104,895 $ 110,628 $ 84,284

Investing Activities ............................ $(90,917) $(129,640) $(102,291)

Financing Activities............................ $ 13,668 $ 13,824 $ 5,244

Operating Activities

Funds provided by operating activities for the fiscal years ended December 26, 2006, December 27, 2005, and

December 25, 2004 were $104.9 million, $110.6 million, and $84.3 million, respectively. Cash flows from

operating activities for the fiscal year ended December 26, 2006 primarily included net income, depreciation and

amortization, stock based compensation, and an increase in accrued expenses, deferred rent and other long-term

liabilities, partially offset by an increase in deferred income taxes, trade and other accounts receivable, and prepaid

expenses. Cash flows from operating activities for the fiscal year ended December 27, 2005 and December 25, 2004

primarily resulted from net income, depreciation and amortization, tax benefit from exercise of stock options, and

an increase in deferred rent and accrued expenses, partially offset by increased trade and other receivables.

Investing Activities

Total capital expenditures for the fiscal year ended December 26, 2006 were $109.3 million and were primarily

related to the opening of 70 Company-owned bakery-cafes and two fresh dough facilities in 2006, costs incurred on

Company-owned bakery-cafes to be opened in the first and second quarter of 2007, and the maintaining or

remodeling of existing bakery-cafes and fresh dough facilities. Additionally, we acquired 13 cafes and one cafe

under construction from two franchisees for approximately $9.1 million. See Note 3 to the Consolidated Financial

Statements for further information on these transactions. Total capital expenditures for the fiscal year ended

December 27, 2005 were $82.1 million and were primarily related to the opening of 66 Company-owned bakery-

cafes in 2005, costs incurred on Company-owned bakery-cafes to be opened in the first and second quarter of 2006,

and the maintaining or remodeling of existing bakery-cafes and fresh dough facilities. Additionally, we acquired 21

cafes and two cafes under construction from a franchisee for $28.0 million. See Note 3 to the Consolidated Financial

Statements for further information on this transaction. Total capital expenditures were $80.4 million for the fiscal

year ended December 25, 2004 and were primarily related to the opening of 54 Company-owned bakery-cafes in

2004, costs incurred on Company-owned bakery-cafes to be opened in the first and second quarter of 2005, and the

maintaining or remodeling of existing bakery-cafes and fresh dough facilities. Additionally, in 2004, we acquired

one bakery-cafe from a franchisee for $0.2 million and acquired the membership interest of the former minority

interest owner for $4.9 million plus the transfer of two bakery-cafes and one bakery-cafe under construction. See

Note 3 to the Consolidated Financial Statements for further information on these transactions.

As of December 26, 2006 and December 27, 2005, we had investments of $20.0 million and $46.3 million,

respectively, in United States treasury notes and government agency securities. Investments are classified as short or

long-term in the accompanying Consolidated Balance Sheets based upon their stated maturity dates. As of

December 26, 2006, all investments were classified as held-to-maturity as we have the intent and ability to hold the

securities to maturity. Held-to-maturity securities are stated at amortized cost, adjusted for amortization of

premiums to maturity, which approximates fair value at December 26, 2006.

Financing Activities

Financing activities provided $13.7 million, $13.8 million, and $5.2 million for the fiscal years ended

December 26, 2006, December 27, 2005, and December 25, 2004, respectively. The financing activities for the

fiscal year ended December 26, 2006 included $7.7 million from the exercise of stock options, $4.3 million from the

tax benefit from exercise of stock options, and $1.6 million from the issuance of common stock under employee

benefit plans. The financing activities in the fiscal year ended December 27, 2005 included $12.6 million from the

28