Panera Bread 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• fluctuations in supply costs, shortages or interruptions;

• negative publicity about the ingredients we use or the occurrence of food-borne illnesses or other problems at

our bakery-cafes;

• natural disasters and other calamities; and

• general economic conditions, both nationally and locally.

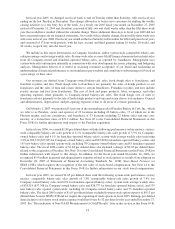

Additionally, our sales have fluctuated by season due to the number and timing of bakery-cafe openings and related

expense, consumer spending patterns and weather. Historically, sales have been higher during the winter holiday season

as a result of increased traffic, higher baked goods sales and family and community gatherings. In fiscal year 2006,

Company-owned bakery-cafes had an aggregate of approximately $155 million in sales in the first quarter which was our

recorded lowest relative quarterly sales in that year and included 9 Company-owned bakery-cafe openings. Compar-

atively, in our fourth quarter we had an aggregate of approximately $189 million in sales with 26 Company-owned

bakery-cafe openings in that quarter recording the highest relative quarterly sales for fiscal year 2006.

Accordingly, results for any one quarter or year are not necessarily indicative of results to be expected for any

other quarter or year.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

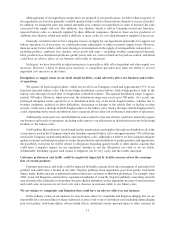

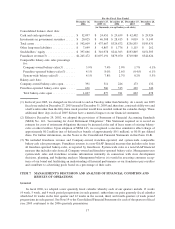

The average size of a Company-owned bakery-cafe is approximately 4,600 square feet. The square footage of

each of our fresh dough facilities is provided below. We lease all of our bakery-cafe locations and fresh dough

facilities. Lease terms for our bakery-cafes and fresh dough facilities are generally for ten years with renewal options

at most locations and generally require us to pay a proportionate share of real estate taxes, insurance, common area,

and other operating costs. Many bakery-cafe leases provide for contingent rental (i.e., percentage rent) payments

based on sales in excess of specified amounts. Certain of our lease agreements provide for scheduled rent increases

during the lease terms or for rental payments commencing at a date other than the date of initial occupancy. See Note 2

to the Consolidated Financial Statements for further information on our accounting for leases.

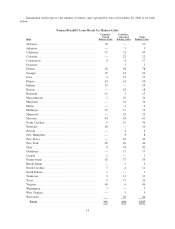

Information with respect to Company-owned leased fresh dough facilities as of December 26, 2006 is set forth

below:

Facility Square Footage

Franklin, MA(1) .................................................... 40,300

Fairfield, NJ ....................................................... 39,200

Chicago, IL ....................................................... 30,900

St. Louis, MO ..................................................... 30,000

Beltsville, MD ..................................................... 22,300

Cincinnati, OH ..................................................... 22,300

Detroit, MI........................................................ 19,600

Atlanta, GA ....................................................... 18,000

Kansas City, KS .................................................... 17,000

Seattle, WA ....................................................... 16,600

Orlando, FL ....................................................... 16,500

Warren, OH ....................................................... 16,300

Stockton, CA ...................................................... 14,300

Ontario, CA ....................................................... 13,900

Minneapolis, MN ................................................... 11,100

Denver,CO ....................................................... 10,000

Greensboro, NC .................................................... 9,600

Dallas, TX ........................................................ 7,800

(1) Total square footage includes approximately 20,000 square feet utilized in tuna and cream cheese production.

13