Panera Bread 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

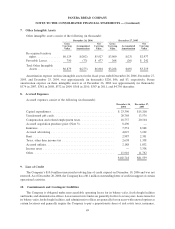

for a purchase price of approximately $28.0 million in cash plus the assumption of certain liabilities including those

associated with bakery-cafe construction. The acquisition price was paid with cash on hand. The Consolidated

Statements of Operations include the results of operations from the bakery-cafes from the date of the acquisition.

The pro forma impact of the acquisition on prior periods is not presented as the impact is not material to reported

results. The Company allocated the purchase price to the tangible and intangible assets acquired and liabilities

assumed in the acquisition at their estimated fair values with the remainder allocated to tax deductible goodwill as

follows: $0.3 million to inventories, $11.6 million to fixed assets, $3.1 million to intangible assets, which represents

the fair value of re-acquired territory rights, which was in accordance with EITF 04-1 effective for acquisitions in

reporting periods beginning after October 13, 2004, and favorable and unfavorable lease agreements, and

$13.0 million to goodwill.

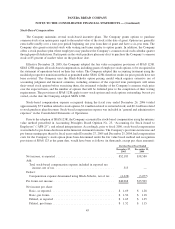

On October 30, 2004, the Company’s wholly-owned subsidiary, Artisan Bread, LLC (“Artisan”), became the

owner of 100% of the membership interests in Cap City Bread, LLC (“LLC”). Prior to the completion of this

transaction, Artisan had owned approximately 78.5% of the membership interests in LLC and the remaining

membership interests had been owned by Capitol Dough, Inc. (“Capitol Dough”), a Missouri corporation owned by

Richard Postle, the Company’s former president (“Postle”), as a minority interest owner. As part of the transaction,

LLC redeemed certain of the membership interests held by Capitol Dough in exchange for the transfer to Capitol

Dough of LLC’s interest in 3 bakery-cafes at cost, one of which was under construction at the acquisition date

(“redemption transaction”). In addition to the redemption transaction, Artisan acquired the remaining membership

interests held by Capitol Dough in exchange for a cash purchase price of approximately $5.2 million (including

acquisition costs), which approximates fair value. Of this purchase price, approximately $4.3 million was paid in

cash at the acquisition date and the remaining purchase price was paid, with interest, in 2005. At the time of the

acquisition, LLC operated 36 bakery-cafes in the northern Virginia and central Pennsylvania markets. The results of

operations of these bakery-cafes have been included in the Company’s Consolidated Financial Statements since the

date of formation of LLC. Following the completion of the transaction, Artisan became the sole owner of LLC,

which then owned 34 bakery-cafes in the northern Virginia and central Pennsylvania markets. The 3 remaining

bakery-cafes transferred to Postle, one of which was under construction at the acquisition date, are owned and

operated by Postle and/or his affiliates as a franchisee. The pro forma impact of the acquisition on prior periods is

not presented as the impact is not material to reported results. The Company allocated the purchase price to the

membership interest and related intangibles acquired in the acquisition at their estimated fair values with any

remainder allocated to tax deductible goodwill as follows: $2.0 million to eliminate the minority interest balance,

$0.3 million to fixed assets, $0.2 million to intangible assets, which represents the fair value of favorable and

unfavorable lease agreements, and $2.7 million to goodwill.

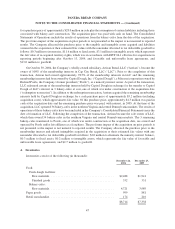

4. Inventories

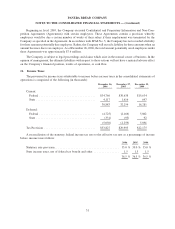

Inventories consist of the following (in thousands):

December 26,

2006

December 27,

2005

Food:

Fresh dough facilities:

Raw materials ........................................ $2,488 $1,941

Finished goods ....................................... 332 331

Bakery-cafes:

Raw materials ........................................ 4,721 3,989

Paper goods ............................................. 999 881

Retail merchandise ........................................ 174 216

$8,714 $7,358

47

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)