Panera Bread 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.adjusted for amortization of premiums to maturity using the effective interest method, which approximates fair

value at December 26, 2006.

Trade and Other Accounts Receivable

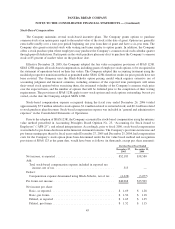

Trade accounts receivable consists primarily of amounts due to the Company from its 41 franchise groups for

purchases of fresh dough from the Company’s fresh dough facilities and royalties due to the Company from

franchisee sales. The Company does not require collateral and maintains reserves for potential uncollectible

accounts based on historical losses and existing economic conditions, when relevant. The allowance for doubtful

accounts at December 26, 2006 and December 27, 2005 was $0.03 million. Other accounts receivable consists

primarily of tenant allowances due from landlords.

Inventories

Inventories, which consist of food products, paper goods and supplies, and promotional items, are valued at the

lower of cost or market, determined under the first-in, first-out method.

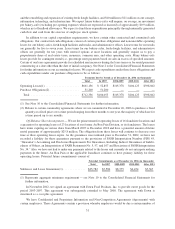

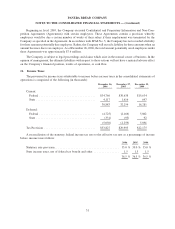

Property and Equipment

Property, equipment, and leaseholds are stated at cost. Depreciation is provided using the straight-line method

over the estimated useful lives of the assets. Leasehold improvements are amortized using the straight-line method

over the shorter of their estimated useful lives or the related reasonably assured lease term. The estimated useful

lives used for financial statement purposes are:

Leasehold improvements ............................................... 15-20 years

Machinery and equipment . . . ........................................... 3-10 years

Furniture and fixtures ................................................. 2-7years

External signage ..................................................... 3-6years

Interest, to the extent it is incurred, is capitalized when incurred in connection with the construction of new

locations or facilities. The capitalized interest is recorded as part of the asset to which it relates and is amortized over

the asset’s estimated useful life. No interest was incurred for such purposes in 2006, 2005, or 2004.

Upon retirement or sale, the cost of assets disposed of and their related accumulated depreciation are removed

from the accounts. Any resulting gain or loss is credited or charged to operations. Maintenance and repairs are

charged to expense when incurred, while betterments are capitalized.

Goodwill

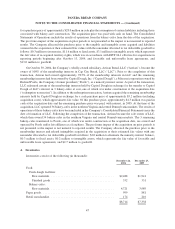

Goodwill consists of the excess of the purchase price over the fair value of net assets acquired from the

acquisitions of the Saint Louis Bread Company, franchise-operated bakery-cafes, a franchise-operated fresh dough

facility, and the membership interest of a former minority interest owner. SFAS No. 142, “Goodwill and Other

Intangible Assets,” requires goodwill and indefinite-lived intangible assets recorded in the financial statements to be

evaluated for impairment annually or when events or circumstances occur indicating that goodwill might be

impaired. When appropriate, the Company performs its impairment assessment by comparing discounted cash

flows from reporting units with the carrying value of the underlying net assets inclusive of goodwill. The Company

completed annual impairment tests as of the first day of the fourth quarter of fiscal years 2006, 2005, and 2004, none

of which identified any impairment.

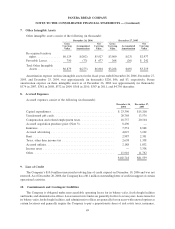

Other Intangible Assets

Other intangible assets consist primarily of the fair value of favorable and unfavorable lease agreements and

the fair value of re-acquired territory rights. The Company is amortizing the fair value of favorable lease agreements

41

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)