Panera Bread 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

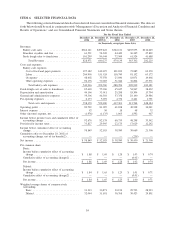

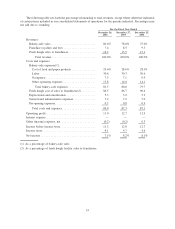

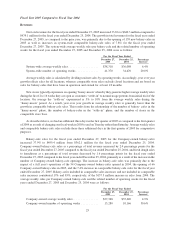

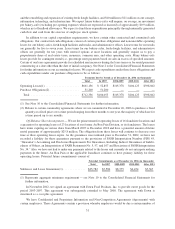

Franchise royalties and fees rose 13.3% to $61.5 million for the fiscal year ended December 26, 2006 from

$54.3 million for the fiscal year ended December 27, 2005. The components of franchise royalties and fees were as

follows (in thousands):

December 26,

2006

December 27,

2005

For the Fiscal Year Ended

Franchise royalties ........................................ $58,686 $51,539

Franchise fees ........................................... 2,845 2,770

Total ................................................ $61,531 $54,309

The increase in royalty revenue can be attributed to the impact of a full year’s operations of the 73 franchise-

operated bakery-cafes opened in 2005, the opening of 85 franchise-operated bakery-cafes in 2006, and the 4.1%

increase in comparable franchise-operated bakery-cafe sales for the fiscal year ended December 26, 2006.

Franchise-operated bakery-cafes included in comparable sales increases and not included in comparable sales

increases contributed 26% and 74%, respectively, of the $156.2 million increase in sales from 2005. The average

weekly sales per franchise-operated bakery-cafe and the related number of operating weeks for the fiscal year ended

December 26, 2006 and December 27, 2005 were as follows:

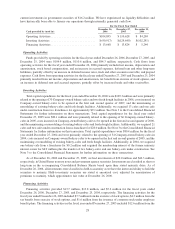

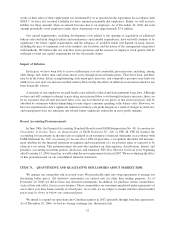

December 26,

2006

December 27,

2005

Percentage

Increase

For the Fiscal Year Ended

Franchisee average weekly sales .................... $39,894 $38,777 2.9%

Franchisee number of operating weeks ............... 31,220 28,090 11.1%

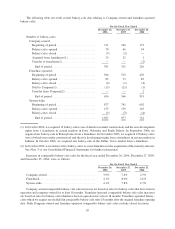

As of December 26, 2006, there were 636 franchise-operated bakery-cafes open and commitments to open 359

additional franchise-operated bakery-cafes. We expect these bakery-cafes to open according to the timetables

established in the various ADAs with franchisees, with the majority opening in the next four to five years. In 2007,

we expect our area developers to open 85 to 90 new franchise-operated bakery-cafes. The ADA requires a

franchisee to develop a specified number of bakery-cafes on or before specific dates. If a franchisee fails to develop

bakery-cafes on schedule, we have the right to terminate the ADA and develop Company-owned locations or

develop locations through new area developers in that market. We may exercise one or more alternative remedies to

address defaults by area developers, including not only development defaults, but also defaults in complying with

our operating and brand standards and other covenants under the ADAs and franchise agreements.

Fresh dough facility sales to franchisees increased 17.1% to $101.3 million for the fiscal year ended

December 26, 2006 from $86.5 million for the fiscal year ended December 27, 2005. The increase was primarily

driven by the increased number of franchise-operated bakery-cafes opened described previously.

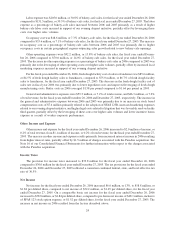

Costs and Expenses

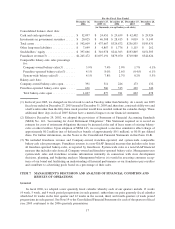

The cost of food and paper products includes the costs associated with the fresh dough operations that sell fresh

dough products to Company-owned bakery-cafes, as well as the cost of food and paper products supplied by third

party vendors and distributors. The costs associated with the fresh dough operations that sell fresh dough products to

the franchise-operated bakery-cafes are excluded and are shown separately as fresh dough cost of sales to

franchisees in the Consolidated Statements of Operations. The cost of food and paper products increased to

29.6% of bakery-cafe sales for the fiscal year ended December 26, 2006 compared to 28.6% of bakery-cafe sales for

the fiscal year ended December 27, 2005. This increase in the cost of food and paper products as a percentage of

bakery-cafe was mainly due to higher food costs incurred in support of our evening daypart initiative, primarily

related to sampling of our Crispani», increased paper costs related to our Via Panera»catering business, higher costs

from increased credit card transactions as a percentage of overall transactions, and higher cost and mix impact of

antibiotic free chicken, partially offset by improved leveraging of fresh dough manufacturing costs we achieved as

more bakery-cafes were opened. For the fiscal year ended December 26, 2006, there was an average of 50.7 bakery-

cafes per fresh dough facility compared to an average of 48.0 for the fiscal year ended December 27, 2005.

23