Panera Bread 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

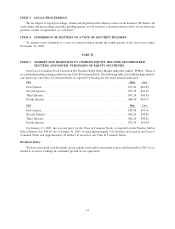

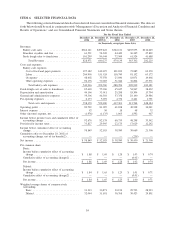

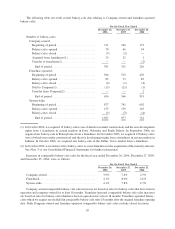

Reconciliation of Non-GAAP Measurements to GAAP Results

In addition to the results provided in accordance with Generally Accepted Accounting Principles (or GAAP)

throughout this report, we have provided certain non-GAAP measurements to conform 2005 results to the 2006

presentation related to our stock option expense and to exclude the impact of a non-recurring charge on the 2006

results relative to the Paradise transaction. Effective December 28, 2005, the beginning of our first quarter of 2006,

we adopted the fair value recognition provisions of SFAS 123R, which required all stock-based compensation,

including grants of employee stock options to be recognized in the statement of operations based on their fair

values. We adopted this accounting treatment using the modified prospective transition method, as permitted under

SFAS 123R; therefore results for prior periods have not been restated. Prior to the adoption of SFAS 123R, we

accounted for stock-based compensation using the intrinsic value method prescribed in Accounting Principles

Board Opinion No. 25, Accounting for Stock Issued to Employees, and related interpretations. Accordingly, stock-

based compensation was included as pro forma disclosure in the financial statement footnotes. Further, we incurred

a non-recurring charge of $0.03 per diluted share in the fourth quarter of fiscal 2006 related to the Paradise

acquisition.

We are providing the table below because management believes it provides useful information to investors

regarding our results of operations by providing current and prior reported amounts on a comparable basis. The pro

forma net income of $59.9 million and earnings per share of $1.87 for the fiscal year ended December 26, 2006, and

pro forma net income of $48.1 million and earnings per share of $1.52 for the fiscal year ended December 27, 2005

are considered “non-GAAP financial measures” under applicable SEC rules because they are adjusted to include

stock-based compensation expense in 2005, and to exclude a non-recurring charge in the fourth quarter of fiscal

2006 relative to the Paradise transaction, which are not included in the directly comparable measures calculated in

accordance with GAAP. These non-GAAP financial measures are not a substitute for the reported GAAP measures.

The adjustment for stock-based compensation expense and Paradise charge had the following effect on

reported amounts (in thousands, except earnings per share):

December 26,

2006

December 27,

2005

Percentage

Increase

For the Fiscal Year Ended

(pro-forma)

Net income, as reported .......................... $58,849 $52,183

Less: Stock-based compensation expense included in

footnote, net of tax ............................ — (4,115)

Net income, as reported/pro forma fiscal year ended

December 27, 2005 ............................ 58,849 48,068 22%

Plus: Paradise non-recurring charge, net of tax .......... 1,072

Net income pro forma fiscal year ended December 26,

2006 and December 27, 2005, respectively ........... $59,921 $48,068 25%

Diluted earnings per share, as reported ............... $ 1.84 $ 1.65

Less: Stock-based compensation expense included in

footnote, net of tax ............................ — (0.13)

Diluted earnings per share, as reported/pro forma fiscal

year ended December 27, 2005 ................... 1.84 1.52 21%

Plus: Paradise non-recurring charge, net of tax .......... 0.03 —

Diluted earnings per share, pro forma fiscal year ended

December 26, 2006 and December 27, 2005,

respectively .................................. $ 1.87 $ 1.52 23%

Shares used in diluted earnings per share calculation ..... 32,044 31,651

21