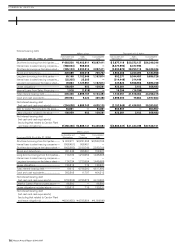

Nissan 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

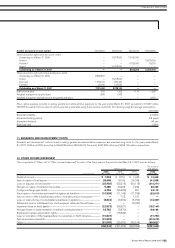

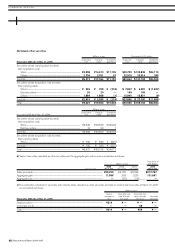

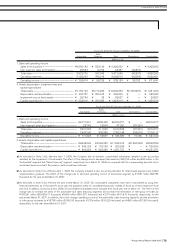

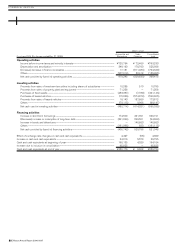

Fiscal year 2005 (For the year ended Mar. 31, 2006)

Sales

Automobile Financing Total Eliminations Consolidated

Millions of yen

I. Sales and operating income

Sales to third parties........................................................................... ¥8,895,143 ¥ 533,149 ¥ 9,428,292 ¥ — ¥ 9,428,292

Inter-segment sales and transfers........................................... 28,563 14,794 43,357 (43,357) —

Total sales.................................................................................................... 8,923,706 547,943 9,471,649 (43,357) 9,428,292

Operating expenses............................................................................ 8,160,292 478,218 8,638,510 (82,059) 8,556,451

Operating income.................................................................................. ¥ 763,414 ¥ 69,725 ¥ 833,139 ¥ 38,702 ¥ 871,841

II. Assets, depreciation, impairment loss and

capital expenditures

Total assets ................................................................................................ ¥7,152,144 ¥5,710,239 ¥12,862,383 ¥(1,380,957) ¥11,481,426

Depreciation and amortization.................................................... ¥ 400,787 ¥ 254,615 ¥ 655,402 ¥ — ¥ 655,402

Impairment loss on fixed assets................................................ ¥ 26,794 ¥ 33 ¥ 26,827 ¥ — ¥ 26,827

Capital expenditures........................................................................... ¥ 503,916 ¥ 920,398 ¥ 1,424,314 ¥ — ¥ 1,424,314

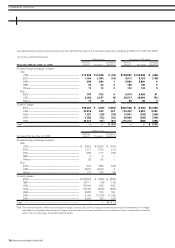

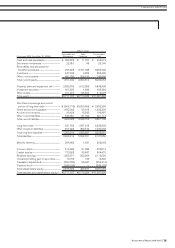

Fiscal year 2004 (For the year ended Mar. 31, 2005)

Sales

Automobile Financing Total Eliminations Consolidated

Millions of yen

I. Sales and operating income

Sales to third parties................................................................................... ¥8,177,841 ¥398,436 ¥8,576,277 ¥ — ¥8,576,277

Inter-segment sales and transfers................................................... 23,742 13,509 37,251 (37,251) —

Total sales............................................................................................................ 8,201,583 411,945 8,613,528 (37,251) 8,576,277

Operating expenses.................................................................................... 7,429,760 338,388 7,768,148 (53,031) 7,715,117

Operating income.......................................................................................... ¥ 771,823 ¥ 73,557 ¥ 845,380 ¥ 15,780 ¥ 861,160

II. Assets, depreciation and capital expenditures

Total assets ........................................................................................................ ¥6,646,594 ¥4,596,322 ¥11,242,916 ¥(1,394,393) ¥9,848,523

Depreciation and amortization............................................................ ¥ 349,163 ¥ 176,763 ¥ 525,926 ¥ — ¥ 525,926

Capital expenditures................................................................................... ¥ 469,283 ¥ 582,468 ¥ 1,051,751 ¥ — ¥1,051,751

Nissan Annual Report 2006-2007 73

FINANCIAL SECTION»

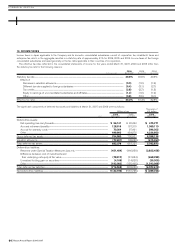

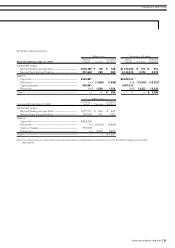

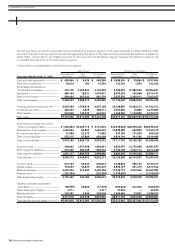

a) As described in Note 2 (b), effective April 1, 2005, the Company and its domestic consolidated subsidiaries adopted a new accounting

standard for the impairment of fixed assets. The effect of this change was to decrease total assets by ¥26,794 million and ¥33 million in the

“Automobile” segment and “Sales Financing” segment, respectively, as of March 31, 2006 as compared with the corresponding amounts which

would have been recorded if the previous method had been followed.

b) As described in Note 2 (c), effective April 1, 2006, the Company adopted a new accounting standard for share-based payment and related

implementation guidance. The effect of this change was to decrease operating income of automobile segment by ¥1,037 million ($8,788

thousand) for the year ended March 31, 2007.

c) As described in Note 2 (e), effective the year ended March 31, 2007, 22 consolidated subsidiaries have been consolidated by using their

financial statements as of the parent's fiscal year end prepared solely for consolidated purposes instead of those as of their respective fiscal

year end. In addition, during fiscal year 2006, 33 consolidated subsidiaries have changed their fiscal year end to March 31. The effect of this

change was to increase net sales of the automobile and sales financing segments and increase the elimination of inter-group net sales by

¥759,391 million ($6,435,517 thousand), ¥9,586 million ($81,237 thousand) and ¥1,371million ($11,618 thousand), respectively, for the

year ended March 31, 2007. In addition, due to this change, operating income of the automobile, sales financing segments and the elimination

of inter-group increased by ¥18,785 million ($159,195 thousand), ¥1,796 million ($15,220 thousand) and ¥862 million ($7,305 thousand),

respectively, for the year ended March 31, 2007.