Nissan 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2006-2007

16

1,000

850

700

550

FY05

O.P.

FY06

w/Q5

O.P.

Scope

of con-

solida-

tion

Price/

Volume

mix

Selling

expenses

(Incl.

incentives)

Pur-

chasing

cost

reduc-

tion

Product

enrichment

and

regulatory

costs

R&D

expenses

Manu-

facturing

expenses

Warranty

expenses

G&A

others

871.8

FY06

12

months

O.P.

755.5

+8.4

–156.3

–21.8

+170.0

Raw

material/

Energy

cost

–110.1

–66.3 –1.4 –4.9 +1.9

–6.6 776.9

Q5

Effect

+21.4

FOREX

+70.8

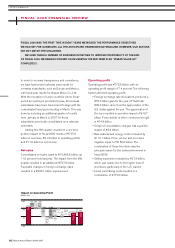

Impact on Operating Profit

(Billion Yen)

FISCAL 2006 WAS THE FIRST TIME IN EIGHT YEARS WE MISSED THE PERFORMANCE OBJECTIVES

WE HAD SET FOR OURSELVES. ALL THE ANTICIPATED HEADWINDS MATERIALIZED. HOWEVER, OUR ACTIONS

DID NOT MATCH THE CHALLENGE.

WE HAVE TAKEN A NUMBER OF BUSINESS INITIATIVES TO IMPROVE PROFITABILITY AT THE END

OF FISCAL 2006. WE REMAIN FOCUSED ON DELIVERING THE MID-TERM PLAN “NISSAN VALUE-UP”

COMPLETELY.

In order to increase transparency and consistency,

we have harmonized calendar year results for

overseas subsidiaries, such as Europe and Mexico,

with fiscal year results for Nissan Motor Co., Ltd.

With the exception of some countries where fiscal-

period accounting is precluded by law, all overseas

subsidiaries have been harmonized to align with the

consolidated fiscal period ending in March. This was

done by including an additional quarter of results

from January to March in 2007 for those

subsidiaries previously consolidated on a calendar

year basis.

Adding this fifth quarter resulted in a one time

positive impact to fiscal 2006 results of ¥767.6

billion in revenues, ¥21.4 billion in operating profits

and ¥11.6 billion in net income.

Net sales

Consolidated net sales came to ¥10,468.6 billion, up

11.0 percent from last year. The impact from the fifth

quarter resulted in an additional ¥767.6 billion.

Favorable changes in foreign exchange rates

resulted in a ¥326.1 billion improvement.

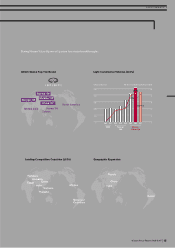

Operating profit

Operating profit was ¥776.9 billion, with an

operating profit margin of 7.4 percent. The following

factors affected operating profit:

• Foreign exchange rate fluctuations produced a

¥70.8 billion gain for the year. Of that total,

¥39.2 billion came from the appreciation of the

U.S. dollar against the yen. The appreciation of

the euro resulted in a positive impact of ¥16.7

billion. Forex activity in other currencies brought

in ¥14.9 billion.

• Scope of consolidation changes had a positive

impact of ¥8.4 billion.

• Raw material and energy costs increased by

¥110.1 billion. Price, volume and mix had a

negative impact of ¥156.3 billion. The

combination of these two items was the

principal reason for the underachievement in

fiscal 2006.

• Selling expenses increased by ¥21.8 billion,

which was mainly due to the higher level of

incentives, particularly in the U.S. market.

• Lower purchasing costs resulted in a

contribution of ¥170.0 billion.

FISCAL 2006 FINANCIAL REVIEW

»PERFORMANCE