Nissan 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

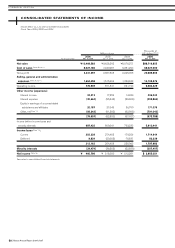

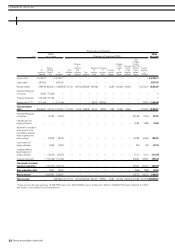

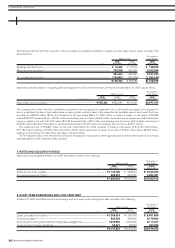

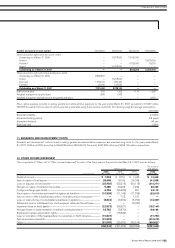

Thousands of

Millions of yen U.S. dollars (Note 3)

2006 2005 2004 2006

For the years ended Mar. 31, 2007 Mar. 31, 2006 Mar. 31, 2005 Mar. 31, 2007

Operating activities

Income before income taxes and minority interests ¥ 697,432 ¥ 809,041 ¥ 793,233 $ 5,910,441

Depreciation and amortization relating to:

Leased assets 305,402 236,572 157,346 2,588,153

Other assets 465,821 418,830 368,580 3,947,636

Impairment loss 22,673 26,827 — 192,144

Provision for (reversal of) allowance for doubtful receivables 9,996 4,561 (6,464) 84,712

Loss on devaluation of securities 459 212 128 3,890

Interest and dividend income (25,546) (21,080) (16,274) (216,492)

Interest expense 145,547 104,265 73,220 1,233,449

Gain on sales of tangible fixed assets (28,485) (16,742) (24,038) (241,398)

Loss on disposal of fixed assets 25,403 22,213 20,115 215,280

Gain on sales of securities (3,566) (40,223) (7,232) (30,220)

Amortization of net retirement benefit obligation at transition 10,928 11,145 11,795 92,610

Provision for accrued retirement benefits 55,438 63,564 65,103 469,814

Retirement benefits paid (157,821) (314,349) (82,924) (1,337,466)

Other 12,118 13,587 (115) 102,695

Changes in operating assets and liabilities:

Notes and accounts receivable (114,960) 90,391 15,494 (974,237)

Finance receivables 44,341 (311,685) (794,349) 375,771

Inventories (88,765) (117,120) (108,903) (752,246)

Notes and accounts payable 54,368 88,129 152,213 460,744

Subtotal 1,430,783 1,068,138 616,928 12,125,280

Interest and dividends received 24,622 21,034 16,098 208,661

Interest paid (143,650) (102,219) (71,318) (1,217,373)

Income taxes paid (268,928) (229,084) (192,293) (2,279,051)

Net cash provided by operating activities 1,042,827 757,869 369,415 8,837,517

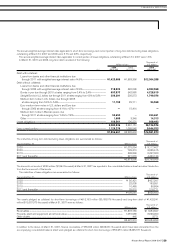

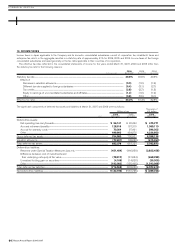

Investing activities

Decrease (increase) in short-term investments 7,210 7,078 (12,370) 61,102

Purchases of investment securities (17,117) (23,930) (31,896) (145,059)

Proceeds from sales of investment securities 36,486 46,060 3,098 309,203

Long-term loans made (12,625) (3,549) (4,019) (106,992)

Collection of long-term loans receivable 4,211 3,225 4,860 35,686

Purchases of fixed assets (546,848) (471,029) (461,146) (4,634,305)

Proceeds from sales of property, plant and equipment 72,308 55,790 71,256 612,780

Purchases of leased vehicles (957,356) (953,285) (590,605) (8,113,186)

Proceeds from sales of leased vehicles 304,912 264,124 173,812 2,584,000

Purchase of subsidiaries’ shares resulting in changes

in scope of consolidation (Note 15) (1,391) — (1,292) (11,788)

Proceeds from sales of subsidiaries’ shares resulting

in changes in scope of consolidation (Note 15) 1,308 4,705 7,697 11,085

Additional acquisition of shares of consolidated subsidiaries —(16,020) (500) —

Other (5,685) (25,924) (23,930) (48,179)

Net cash used in investing activities (1,114,587) (1,112,755) (865,035) (9,445,653)

Financing activities

Increase in short-term borrowings 492,538 376,048 666,191 4,174,051

Increase in long-term borrowings 969,461 883,548 1,050,841 8,215,771

Increase in bonds and debentures 123,730 390,706 140,663 1,048,559

Repayment of long-term borrowings (1,102,015) (809,466) (765,588) (9,339,110)

Redemption of bonds and debentures (190,515) (200,840) (379,946) (1,614,534)

Proceeds from minority shareholders 260 1,321 30 2,203

Purchases of treasury stock (10,375) (22,208) (33,366) (87,924)

Proceeds from sales of treasury stock 29,087 26,423 6,816 246,500

Repayment of lease obligations (66,775) (76,071) (69,244) (565,890)

Cash dividends paid (131,064) (105,661) (94,236) (1,110,712)

Cash dividends paid to minority shareholders (7,453) (6,487) (678) (63,161)

Other 33 606 (437) 281

Net cash provided by financing activities 106,912 457,919 521,046 906,034

Effect of exchange rate changes on cash and cash equivalents 16,640 11,389 4,369 141,017

Increase in cash and cash equivalents 51,792 114,422 29,795 438,915

Cash and cash equivalent at beginning of the year 404,212 289,784 194,164 3,425,525

Increase due to inclusion in consolidation 13,384 6 65,825 113,424

Cash and cash equivalent at end of the year ¥ 469,388 ¥ 404,212 ¥ 289,784 $ 3,977,864

See notes to consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Nissan Motor Co., Ltd. and Consolidated Subsidiaries

Fiscal Years 2006, 2005 and 2004

Nissan Annual Report 2006-2007

54

»FINANCIAL SECTION