Nissan 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

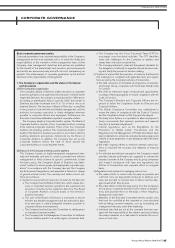

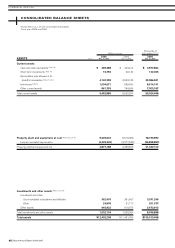

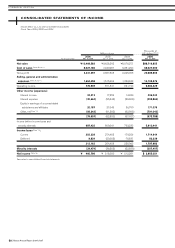

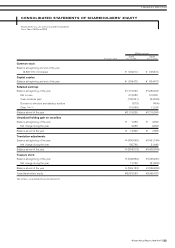

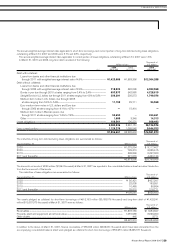

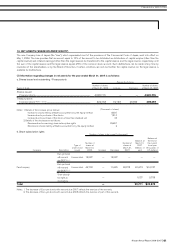

Millions of yen

2005 2006

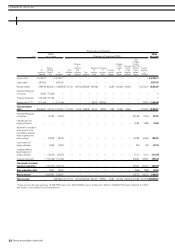

As of Mar. 31, 2006 Changes in fiscal year 2006

Mar. 31, 2007

Common stock ¥ 605,814 —¥ 605,814 ————————— —¥ 605,814

Capital surplus 804,470 — 804,470 ————————— —804,470

Retained earnings 2,116,825 ¥(35,664) 2,081,161 ¥(131,064) ¥(560)¥460,796 ¥(3,477) — ¥361 ¥(3,728) ¥(763) — ¥321,565 2,402,726

Unrealized holding gain

on securities 14,340 (14,340) — ————————— — —

Translation adjustments (204,313) 204,313 — ————————— — —

Treasury stock (Note 10) * (249,153) — (249,153) — — — 33,134 ¥(10,375) ————22,759 (226,394)

Total shareholders’

equity ¥3,087,983 154,309 3,242,292 (131,064) (560) 460,796 29,657 (10,375) 361 (3,728) (763) — 344,324 3,586,616

Unrealized holding

gain on securities — 14,340 14,340 ————————¥(8,514) (8,514) 5,826

Unrealized gain from

hedging instruments — — — ————————1,817 1,817 1,817

Adjustment for revaluation

of the accounts of the

consolidated subsidiaries

based on general price

level accounting — 49,915 49,915 ————————19,008 19,008 68,923

Land revaluation of foreign

subsidiaries — 5,134 5,134 ————————(39)(39)5,095

Unfunded retirement benefit

obligation of foreign

subsidiaries — (19,385) (19,385) ————————5,559 5,559 (13,826)

Translation adjustments — (204,313) (204,313) ————————95,099 95,099 (109,214)

Total valuation, translation

adjustments and others — (154,309) (154,309) ————————112,930 112,930 (41,379)

Share subscription rights — 3,144 3,144 ————————(433) (433) 2,711

Minority interests — ¥285,893 285,893 ————————43,153 43,153 329,046

Total net assets — —¥3,377,020 ¥(131,064) ¥(560)¥460,796 ¥29,657 ¥(10,375) ¥361 ¥(3,728) ¥(763) ¥155,650 ¥499,974 ¥3,876,994

* Treasury stock has decreased by 13,465,783 shares from 422,762,529 shares at March 31, 2006 to 409,296,746 shares at March 31, 2007.

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

Nissan Motor Co., Ltd. and Consolidated Subsidiaries

Fiscal Year 2006

Nissan Annual Report 2006-2007 51

FINANCIAL SECTION»

As

previously

reported

Reclas-

sification

(Note 2

(d)) As

restated

Cash

dividends

paid

Bonuses

to

directors

and

statutory

auditors Net

income

Disposal

of

treasury

stock

Purchases

of

treasury

stock

Changes

due to

merger

Changes

in the

scope

of

consoli-

dation

Changes

in the

scope

of equity

method

Net

changes

in items

other than

those in

share-

holders’

equity

Total of

changes

in

FY2006