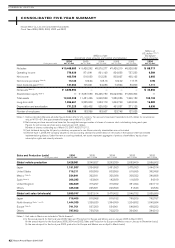

Nissan 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2006-2007 39

currency risk between your revenue footprint and

your expense footprint. That’s why it’s so important to

work with local people, and avoid shadow

localization—just assembling parts from abroad.

Our dealership strategy is to build a dedicated

Nissan network without buying the assets, so we’re

going to be making deals with specific partners that will

own those dealerships. To meet our projected growth

in India during the next decade, we will need to grow

our dealer network significantly. We want to hedge

the business risk in India by having one partner for

manufacturing and a different one for distribution,

because understanding local business practices and

labor regulations, as well as managing union

relationships and media relationships, are specific skills.

Using India as an LCC or leading competitive

country is a huge challenge. First you need to have a

localization rate of 90 percent or higher. That’s

possible if the powertrain is localized—at least the

assembly and some core parts. Second, procure

parts from the local supplier base. Third, don’t just

throw the specs on the table and ask your suppliers

to build. That means leveraging the skills of our

engineers, who will continue to shift their mindset.

To compete successfully in India, we need to

redesign our vehicle parts to adjust for local factory

tools, the local way of doing things, and even

different materials.

We will be making cars at Chennai for the

segment in which the price pressure is highest—

compacts. We plan to bring a family of small cars

based on one specific small platform and

progressively expand it for both domestic sales and

exports. There is risk, but if you don’t go to India

there’s a certainty that you’ll be out of the low-end

market—the price band below ten or eleven

thousand dollars worldwide—which is enormous.

Look at Russia. The market is moving so fast

there. When we made the decision to build the

St. Petersburg plant, we were just on the limits of

being too late. The foreign makers are doing well

there by importing finished vehicles, and this could

last for one or two more years. However, if you’re not

localized in Russia by 2009, you’ll be out for

everything between ten and twenty thousand dollars.

India is a similar game.

INVESTMENT FOR THE FUTURE »

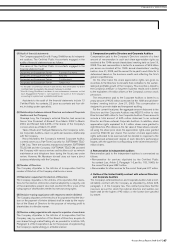

The signing of MOU with Mahindra & Mahindra, Renault and Nissan Geographic expansion – India

Mumbai

Chennai

Nissan Motor India

HQ

Delhi

The new production

site in 2009