Nissan 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2006-2007 17

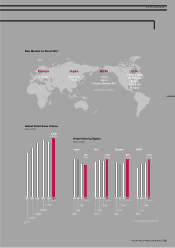

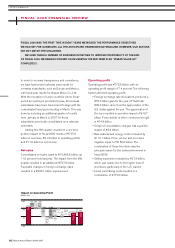

1,400

1,050

700

350

0

Free cash flow

¥21.0 billion

Financing

activities

–¥165.7 billion

Net

automotive

cash at

beginning

of FY06

Net

automotive

cash at the

end of

FY06

Net cash

from

operations

Working

capital

and

others

Investing

activities

Dividend

paid FX rate

impact

+1,038.6 –255.1

–496.8

Tax

paid

–265.7

–131.1

372.9

Other

financial

activities

–53.3 +26.5

Treasury

stock

+18.7

254.7

Net Cash Flow (automotive)

(Billion Yen)

• Product enrichment, including regulatory costs,

had a negative impact of ¥66.3 billion.

• R&D expenses increased by ¥1.4 billion.

• Manufacturing and logistics expenses went up

by ¥4.9 billion.

• Warranty expenses had a positive impact of

¥1.9 billion.

• General, administrative and other expenses rose

¥6.6 billion.

• As previously mentioned, the inclusion of an

additional quarter from former December

ending companies generated a positive impact

of ¥21.4 billion.

By region, for fiscal 2006, operating profits in

Japan were ¥270.6 billion, which decreased from

¥390.4 billion in fiscal 2005. Although mini cars

remained a profitable business, the deterioration in

mix and decrease in overall volumes in Japan were

the main reasons for the decline in profitability.

Profitability in the U.S. and Canada was ¥282.6

billion, versus ¥345.4 billion last year. Thirty percent

of the decline in U.S. profitability was attributable to

the QR 25 engine recall, which was booked in

regional accounts. In Europe, operating profit

increased to ¥79.6 billion in fiscal 2006 from ¥67.2

billion in fiscal 2005. In the General Overseas

Markets, operating profit was ¥113.3 billion, versus

¥101.2 billion last year. Inter-regional eliminations

resulted in a positive ¥9.4 billion.

Net income

Net non-operating expenses came to ¥15.8 billion,

improving from last year’s ¥25.9 billion due to the

absence of a negative foreign exchange impact.

Net extraordinary items totaled negative ¥63.7

billion, ¥26.8 billion higher than last year. Included in

this year’s extraordinary items were headcount

reduction programs in the U.S. and Japan, which were

announced in April, with an impact of ¥28.0 billion.

Pre-tax income was ¥697.4 billion. Taxes totaled

¥212.1 billion, which represented an effective

consolidated tax rate of 30.4 percent.

Minority interests, which are profits from fully

consolidated companies that Nissan does not own

outright, such as Calsonic Kansei, Aichi Kikai and

Nissan Shatai, amounted to ¥24.5 billion. Net income

reached ¥460.8 billion, versus ¥518.1 billion in

fiscal 2005.

FINANCIAL POSITION

Balance sheet

In fiscal 2006, Nissan’s total consolidated assets

went up by 8.0 percent to ¥12,402.2 billion.

Current assets increased by 7.8 percent to

¥6,492.9 billion. The main reasons were the ¥190.5

billion increase in notes and accounts receivables and

a ¥148.2 billion increase in inventories. Fixed assets

increased to ¥5,909.3 billion, an 8.3 percent rise.

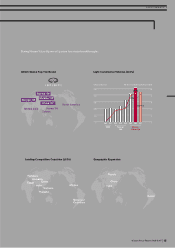

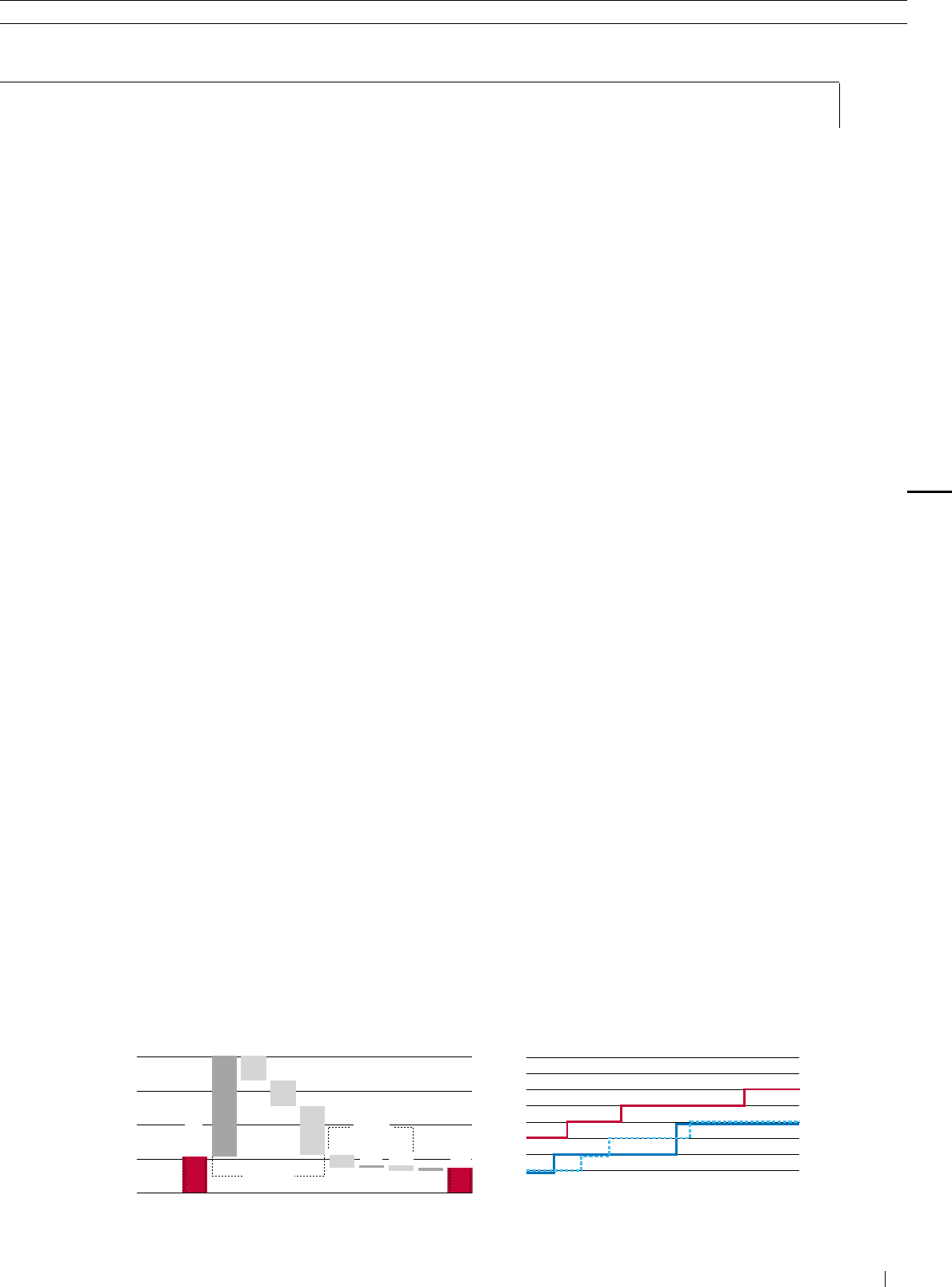

Moody’s

S&P

R&I

A+

AA–

A

A–

BBB+

BBB

BBB–

BB+

Aa3

A1

A2

A3

Baa1

Baa2

Baa3

Ba1

9/01 4/02 9/02 4/03 9/03 4/04 9/04 4/05 9/05 4/06

Corporate Rating

PERFORMANCE »