Nissan 2007 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

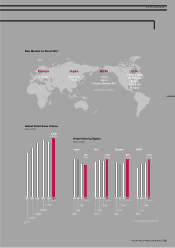

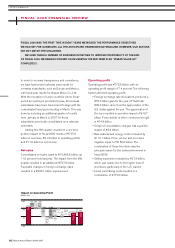

500

400

300

200

6

5

4

3

FY

’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07

(Forecast)

4.0% 3.8%

4.2% 4.4%

4.8%

4.6% 4.7%

4.4%

4.8%

239 232

262

300

354

398

448 465 490

R&D (left scale) % of net revenue (right scale)

Nissan Annual Report 2006-2007

18

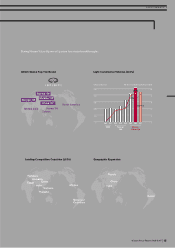

40

30

20

10

0

FY

’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07

(Forecast)

7

0

8

14

19

24

29

34

40

NRP Nissan 180 Nissan

Value-Up

Dividend Policy

(Dividend per share, in yen)

Current liabilities went up 14.9 percent to

¥5,575.3 billion. This was due to increases in short

term borrowings. Non-current liability decreased by

9.4 percent from fiscal 2005 to ¥2,949.9 billion.

This was mainly caused by the decrease in long

term borrowings.

Net assets increased 14.8 percent to ¥3,877.0

billion compared to ¥3,377.0 billion in fiscal 2005,

which had been adjusted for related implementation

guidance. This was mainly due to the increase in net

income of ¥460.8 billion, which was offset by the

decrease of ¥131.1 billion in dividends paid.

Automotive net cash change

Cash from operations totaled ¥1,038.6 billion. Free

cash flow totaled ¥21.0 billion by increased working

capital, tax payment and capital expenditures. Cash

outflow from financing activities totaled ¥165.7

billion, including ¥131.1 billion for dividend payments.

We had a net cash position of ¥254.7 billion at

the end of fiscal 2006, which represented a

decrease of ¥118.2 billion compared to the

beginning of the fiscal year. This was due to the

decrease in cash from operations and increase in

capital expenditures.

Credit rating

R&I had Nissan’s long term credit rating listed as A,

as of May 16, 2005. S&P upgraded our rating from

BBB to BBB+ on July 20, 2004, and Moody’s

upgraded us from Baa3 to Baa1 on March 9, 2004.

Investment policy

Capital expenditures were ¥509.0 billion, or 4.9

percent of net revenue. This included the

investments in “New Design Center” and “Nissan

Advanced Technology Center”. R&D expenditures

were ¥464.8 billion. The funds were used for

developing new technologies and products. Our R&D

strategy is focused, sustainable and innovative.

This strategy is a result of our cross-functional

corporate culture.

And through the Alliance, we now have an

extensive collaboration with Renault’s R&D.

Dividend

At the annual general meeting of shareholders on

June 20, 2007, the company proposed increasing its

dividend to ¥34 per share in fiscal 2006, which was

an increase from ¥29 in 2005. And we will maintain

the dividend payment plan of ¥40 per share at the

end of Nissan Value-Up in March 2008.

Return on invested capital

At the end of fiscal 2006, return on invested capital

(ROIC) was 15.3 percent. This decline from 19.4

percent in fiscal 2005 was mainly due to the

decrease in operating profit.

Nissan will continue to ensure that investments

are made within the strict guidelines of its operating

policies.

R&D Expenditure

(Billion Yen) (% of net revenue)

»PERFORMANCE