Nissan 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

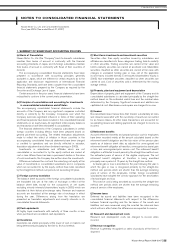

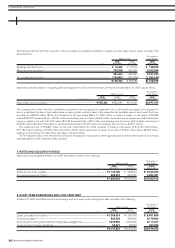

(a) Basis of Presentation

Nissan Motor Co., Ltd. (the “Company”) and its domestic subsidiaries

maintain their books of account in conformity with the financial

accounting standards of Japan, and its foreign subsidiaries maintain

their books of account in conformity with those of their countries of

domicile.

The accompanying consolidated financial statements have been

prepared in accordance with accounting principles generally

accepted in Japan, which are different in certain respects as to the

application and disclosure requirements of International Financial

Reporting Standards, and have been compiled from the consolidated

financial statements prepared by the Company as required by the

Securities and Exchange Law of Japan.

Certain amounts in the prior years’ financial statements have been

reclassified to conform to the current year’s presentation.

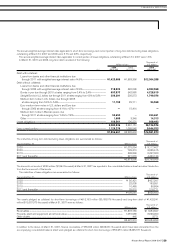

(b) Principles of consolidation and accounting for investments

in unconsolidated subsidiaries and affiliates

The accompanying consolidated financial statements include the

accounts of the Company and any significant companies controlled

directly or indirectly by the Company. Companies over which the

Company exercises significant influence in terms of their operating

and financial policies have been included in the consolidated financial

statements on an equity basis. All significant intercompany balances

and transactions have been eliminated in consolidation.

The financial statements of the Company’s subsidiaries in certain

foreign countries including Mexico have been prepared based on

general price-level accounting. The related revaluation adjustments

made to reflect the effect of inflation in those countries in the

accompanying consolidated financial statements have been charged

or credited to operations and are directly reflected in valuation,

translation adjustments and others (retained earnings in 2005).

Investments in subsidiaries and affiliates which are not

consolidated or accounted for by the equity method are carried at

cost or less. Where there has been a permanent decline in the value

of such investments, the Company has written down the investments.

Differences between the cost and the underlying net equity at fair

value of investments in consolidated subsidiaries and in companies

which are accounted for by the equity method have been amortized

by the straight-line method over periods not exceeding 20 years.

(c) Foreign currency translation

The balance sheet accounts of the foreign consolidated subsidiaries

are translated into yen at the rates of exchange in effect at the

balance sheet date, except for the components of net assets

excluding minority interests (shareholders’ equity in 2005) which are

translated at their historical exchange rates. Revenue and expense

accounts are translated at the average rate of exchange in effect

during the year. Differences arising from the translation are

presented as translation adjustments and minority interests in its

consolidated financial statements.

(d) Cash equivalents

All highly liquid investments with maturity of three months or less

when purchased are considered cash equivalents.

(e) Inventories

Inventories are stated principally at the lower of cost or market, cost

being determined principally by the first-in, first-out method.

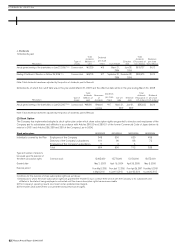

(f) Short-term investments and investment securities

Securities other than equity securities issued by subsidiaries and

affiliates are classified into three categories: trading, held-to-maturity

or other securities. Trading securities are carried at fair value and

held-to-maturity securities are carried at amortized cost. Marketable

securities classified as other securities are carried at fair value with

changes in unrealized holding gain or loss, net of the applicable

income taxes, included directly in net assets (shareholders’ equity in

2005). Non-marketable securities classified as other securities are

carried at cost. Cost of securities sold is determined by the moving

average method.

(g) Property, plant and equipment and depreciation

Depreciation of property, plant and equipment of the Company and its

consolidated subsidiaries is calculated principally by the straight-line

method based on the estimated useful lives and the residual value

determined by the Company. Significant renewals and additions are

capitalized at cost. Maintenance and repairs are charged to income.

(h) Leases

Noncancellable lease transactions that transfer substantially all risks

and rewards associated with the ownership of assets are accounted

for as finance leases. All other lease transactions are accounted for

as operating leases and relating payments are charged to income as

incurred.

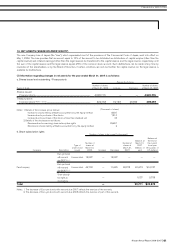

(i) Retirement benefits

Accrued retirement benefits and prepaid pension cost for employees

have been recorded mainly at the amount calculated based on the

retirement benefit obligation and the fair value of the pension plan

assets as of balance sheet date, as adjusted for unrecognized net

retirement benefit obligation at transition, unrecognized actuarial gain

or loss, and unrecognized prior service cost. The retirement benefit

obligation is attributed to each period by the straight-line method over

the estimated years of service of the eligible employees. The net

retirement benefit obligation at transition is being amortized

principally over a period of 15 years by the straight-line method.

Actuarial gain or loss is amortized in the year following the year in

which the gain or loss is recognized primarily by the straight-line

method over periods which are shorter than the average remaining

years of service of the employees. Certain foreign consolidated

subsidiaries have adopted the corridor approach for the amortization

of actuarial gain and loss.

Prior service cost is being amortized as incurred by the straight-line

method over periods which are shorter than the average remaining

years of service of the employees.

(j) Income taxes

Deferred tax assets and liabilities have been recognized in the

consolidated financial statements with respect to the differences

between financial reporting and the tax bases of the assets and

liabilities, and were measured using the enacted tax rates and laws

which will be in effect when the differences are expected to reverse.

(k) Research and development costs

Research and development costs are charged to income when

incurred.

(l) Revenue recognition

Revenue is generally recognized on sales of products at the time of

shipment.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Nissan Motor Co., Ltd. and Consolidated Subsidiaries

Fiscal year 2006 (Year ended March 31, 2007)

Nissan Annual Report 2006-2007 55

FINANCIAL SECTION»