Nissan 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

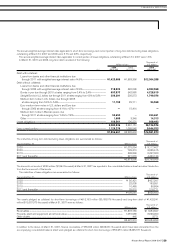

(m) Derivative financial instruments

The Company and certain consolidated subsidiaries have entered into

various derivative transactions in order to manage certain risk arising

from adverse fluctuations in foreign currency exchange rates, interest

rates, and stock and commodity prices. Derivative financial

instruments are carried at fair value with changes in unrealized gain

or loss charged or credited to operations, except for those which

meet the criteria for deferral hedge accounting under which

unrealized gain or loss is deferred as a component of net assets (an

asset or a liability in 2005). See Note 2(a).

(n) New Accounting Standards

In May 2006, the Accounting Standards Board of Japan issued a

new accounting guideline to harmonize the accounting policies of

overseas subsidiaries in the preparation of consolidated financial

statements. This accounting standard will become effective the fiscal

year commencing on or subsequent to April 1, 2008. The Company is

currently assessing the impact of the adoption of this standard on its

consolidated financial statements.

Nissan Annual Report 2006-2007

56

»FINANCIAL SECTION

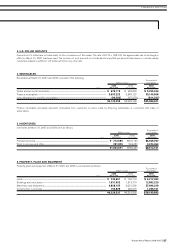

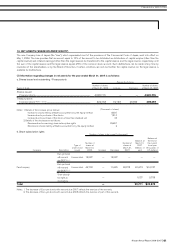

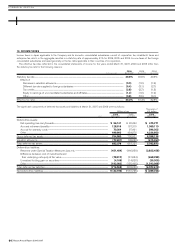

2. ACCOUNTING CHANGES

(a) Until the year ended March 31, 2005, the Company and its

domestic consolidated subsidiaries applied special treatment to

forward foreign exchange contracts entered into to hedge forecasted

sales denominated in foreign currencies. These contracts qualified for

deferral hedge accounting as these sales and accounts receivable

were translated and reflected in the consolidated financial statements

at their corresponding contracted rates.

Effective April 1, 2005, the Company and its domestic subsidiaries

changed their method of accounting for such sales, accounts

receivable and forward foreign exchange contracts and began

applying the benchmark method. Under this method, sales

denominated in foreign currencies are translated into Japanese yen

at the exchange rates in effect at each transaction date and the

related accounts receivable are translated at the exchange rates in

effect at the balance sheet dates, with the related exchange

differences charged or credited to income, whereas the forward

foreign exchange contracts are carried at fair value. This change was

made as a result of the implementation of a newly modified internal

operating system with respect to forward foreign exchange contracts

in order to achieve a better presentation of gain or loss related to

open derivatives positions. The effect of this change on the

consolidated financial statements was immaterial for the year ended

March 31, 2006.

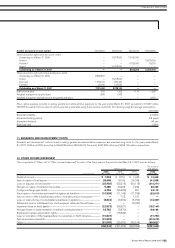

(b) Effective April 1, 2005, the Company and its domestic

consolidated subsidiaries adopted a new accounting standard for the

impairment of fixed assets. The Group bases its grouping for

assessing impairment losses on fixed assets on its business

segments (automobiles and sales finance) and geographical

segments. However, the Group determines whether or not an asset is

impaired on an individual asset basis depending on whether the asset

is deemed idle or if it is scheduled to be disposed of.

As a result of the adoption of this new standard, the Company and

its domestic consolidated subsidiaries have recognized an impairment

loss in the amount of ¥26,827 million on idle assets and assets to be

disposed of due to a significant decline in their market value by

reducing their book value to the respective net realizable value of

each asset. Accordingly, income before income taxes and minority

interests decreased by the same amount for the year ended March

31, 2006 from the corresponding amount which would have been

recorded under the previous method. The effect of this change on

segment information is explained in Note 21.

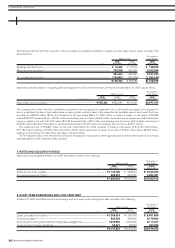

(c) Effective April 1, 2006, the Company adopted a new accounting

standard for share-based payment and related implementation

guidance. The effect of this change was to decrease operating

income, income before income taxes and minority interests by

¥1,037 million ($8,788 thousand) from the corresponding amounts

which would have been recorded if the previous method had been

followed. The effect of this change on segment information is

explained in Note 21.

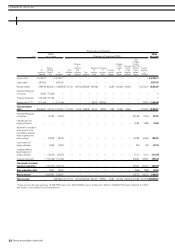

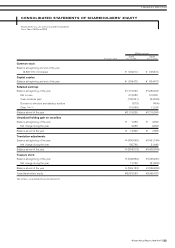

(d) Effective April 1, 2006, the Company adopted a new accounting

standard for presentation of net assets in the balance sheet and

related implementation guidance. Shareholders’ equity under the

previous presentation method amounted to ¥3,543,420 million

($30,028,983 thousand) as of March 31, 2007. In addition, effective

the year ended March 31, 2007, the Company is required to prepare

consolidated statement of changes in net assets instead of

consolidated statements of shareholders’ equity.

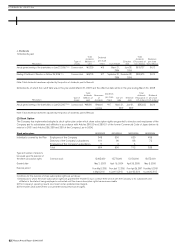

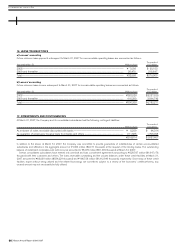

(e) Until the year ended March 31, 2006, since the difference

between the fiscal year end of the parent company and those of 55

consolidated subsidiaries was within three months, the operating

results of those subsidiaries were consolidated by using their

financial statements as of their respective fiscal year ends. Effective

the year ended March 31, 2007, 22 consolidated subsidiaries have

been consolidated by using their financial statements as of the

parent’s fiscal year end prepared solely for consolidation purposes

instead of those as of their respective fiscal year end. This change

was made, upon the completion of the internal reporting systems

which allow those subsidiaries to accelerate their financial statement

closing process, in order to make the disclosures of the consolidated

financial statements more meaningful by unifying the fiscal year. In

addition, 33 consolidated subsidiaries have also changed their fiscal

year end to March 31 for the same reason.

Accordingly, the operating results for the 15-month period from

January 1, 2006 to March 31, 2007 of the 55 consolidated

subsidiaries have been included in the consolidated financial

statements for the year ended March 31, 2007.

As a result, net sales, operating income, income before income

taxes and minority interests and net income increased by ¥767,606

million ($6,505,136 thousand), ¥21,443 million ($181,720

thousand), ¥15,661 million ($132,720 thousand) and ¥11,589

million ($98,212 thousand), respectively, over the corresponding

amounts which would have been reported under the previous method.

The effect of this change on segment information is explained in

Note 21.