NetFlix 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

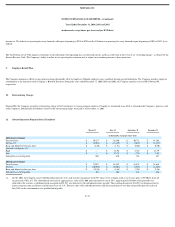

income tax. The federal net operating loss carry forwards will expire beginning in 2012 to 2022 and the California net operating loss carry forwards expire beginning in 2002 to 2012, if not

utilized.

The Tax Reform Act of 1986, imposes restrictions on the utilization of net operating loss carryforwards and tax credit carryforwards in the event of an “ownership change,” as defined by the

Internal Revenue Code. The Company’s ability to utilize its net operating loss carryforwards is subject to restrictions pursuant to these provisions.

9. Employee Benefit Plan

The Company maintains a 401(k) savings plan covering substantially all of its employees. Eligible employees may contribute through payroll deductions. The Company matches employee

contributions at the discretion of the Company’s Board of Directors. During the years ended December 31, 2000, 2001 and 2002, the Company matched a total of $0, $304 and $0,

respectively.

10. Restructuring Charges

During 2001, the Company recorded a restructuring charge of $671 relating to severance payments made to 45 employees terminated in an effort to streamline the Company’s processes and

reduce expenses. Substantially all liabilities related to this restructuring charge were paid as of December 31, 2001.

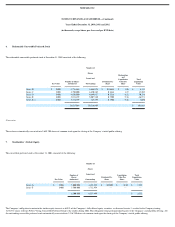

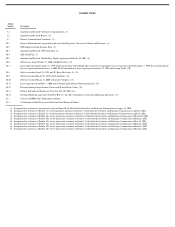

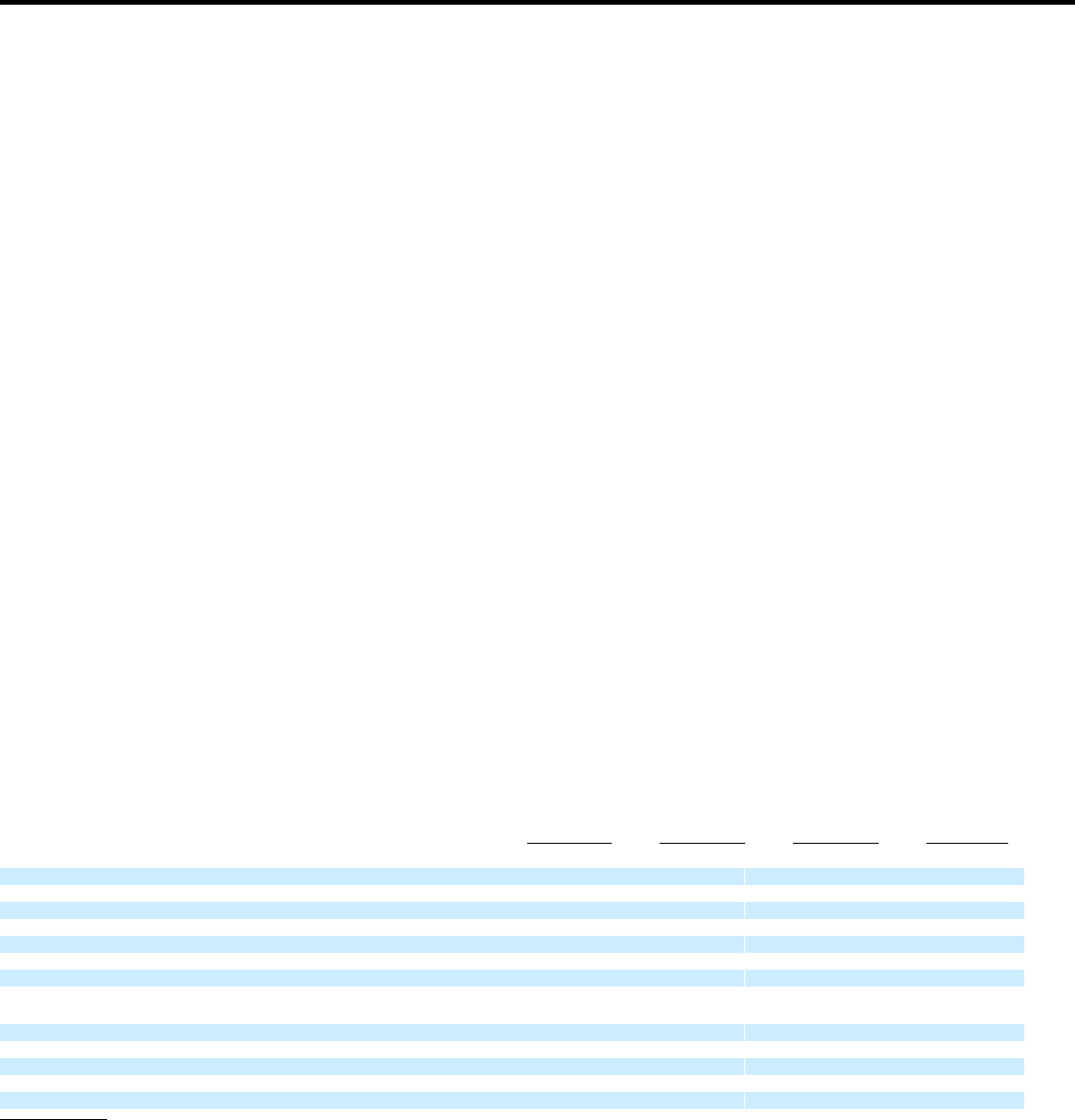

11. Selected Quarterly Financial Data (Unaudited)

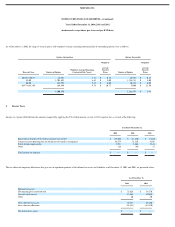

March 31 June 30 September 30 December 31

(in thousands, except per share data)

2002 Quarter Ended:

Total revenues $ 30,527 $ 36,360 $ 40,731 $ 45,188

Net loss (1) $ (4,508) $ (13,429) $ (1,695) $ (2,315)

Basic and diluted net loss per share $ (2.20) $ (1.31) $ (0.08) $ (0.10)

Quarterly stock prices (2):

High $ — $ 16.94 $ 17.87 $ 12.79

Low $ — $ 12.75 $ 9.70 $ 5.22

Subscribers at end of period 603 670 742 857

2001 Quarter Ended:

Total revenues $ 17,057 $ 18,359 $ 18,878 $ 21,618

Net loss $ (20,598) $ (8,001) $ (5,554) $ (4,465)

Basic and diluted net loss per share $ (12.26) $ (4.48) $ (2.94) $ (2.26)

Subscribers at end of period 303 308 334 456

(1) In July 2001, the Company issued subordinated promissory notes and warrants to purchase 6,818,947 shares of its common stock at an exercise price of $3.00 per share for

net proceeds of $12,831. The subordinated notes had an aggregate face value of $13,000 and stated interest rate of 10%. Approximately $10,884 of the proceeds was

allocated to the warrants as additional paid−in capital and $1,947 was allocated to the subordinated notes payable. The resulting discount of $11,053 was being accreted to

interest expense using an effective annual interest rate of 21%. The face value of the subordinated notes and all accrued interest were due and payable upon the earlier of

July 2011 or the consummation of a qualified initial public

F−23