NetFlix 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

The Company’s obligation to maintain the studios’ equity interests at 6.02% of the Company’s fully diluted equity securities outstanding terminated immediately prior to its initial public

offering. The studios’ Series F Preferred Stock automatically converted into 1,596,415 shares of common stock upon the closing of the Company’s initial public offering.

The Company measured the original issuances and any subsequent adjustments using the fair value of the securities at the issuance and any subsequent adjustment dates. The fair value was

recorded as an intangible asset and is amortized to cost of subscription revenues ratably over the remaining term of the agreements which initial terms were either three or five years.

During 2001, in connection with a strategic marketing alliance agreement, the Company issued 416,440 shares of Series F Preferred Stock. These shares automatically converted into 138,813

shares of common stock upon the closing of the Company’s initial public offering. Under the agreement, the strategic partner has committed to provide, on a best−efforts basis, a stipulated

number of impressions to a co−branded Web site and the Company’s Web site over a period of 24 months. In addition, the Company is allowed to use the partner’s trademark and logo in

marketing the Company’s subscription services. The Company recognized the fair value of these instruments as an intangible asset with a corresponding credit to additional paid−in capital.

The intangible asset is being amortized on a straight−line basis to marketing expense over the two−year term of the strategic marketing alliance.

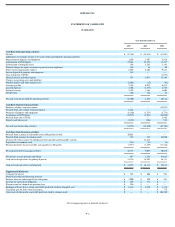

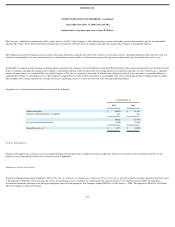

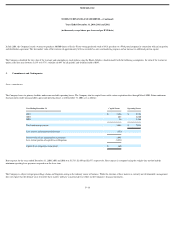

Intangible assets and accumulated amortization consisted of the following:

As of December 31,

2001 2002

Studio intangibles $ 10,210 $ 11,528

Strategic marketing alliance intangibles 416 416

10,626 11,944

Less accumulated amortization (2,709) (5,850)

Intangible assets, net $ 7,917 $ 6,094

Property and equipment

Property and equipment are carried at cost less accumulated depreciation. Depreciation is calculated using the straight−line method over the shorter of the estimated useful lives of the

respective assets, generally up to three years, or the lease term, if applicable.

Impairment of Long−Lived Assets

Statement of Financial Accounting Standards (“SFAS”) No. 144, Accounting for the Impairment or Disposal of Long−Lived Assets , provides a single accounting model for long−lived assets

to be disposed of. SFAS No. 144 also changes the criteria for classifying an asset as held for sale; and broadens the scope of businesses to be disposed of that qualify for reporting as

discontinued operations and changes the timing of recognizing losses on such operations. The Company adopted SFAS No. 144 on January 1, 2002. The adoption of SFAS No. 144 did not

affect the Company’s financial statements.

F−9