NetFlix 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

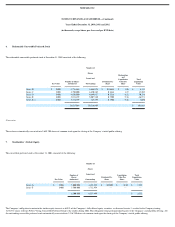

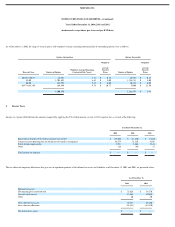

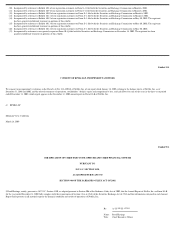

As of December 31, 2002, the range of exercise prices and weighted−average remaining contractual life of outstanding options were as follows:

Options Outstanding Options Exercisable

Exercise Prices Number of Options Weighted−Average Remaining

Contractual Life (Years)

Weighted−

Average

Exercise

Prices Number of Options

Weighted−

Average

Exercise

Prices

$0.15 to $0.33 44,987 5.17 $ 0.15 44,987 $ 0.15

$3.00 3,703,101 8.62 $ 3.00 1,228,213 $ 3.00

$6.00 182,992 9.25 $ 6.00 10,333 $ 6.00

$8.97 to $13.99 169,450 9.74 $ 10.77 5,000 $ 13.50

4,100,530 1,288,533 $ 2.98

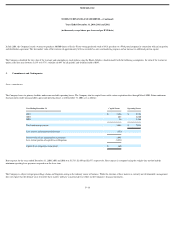

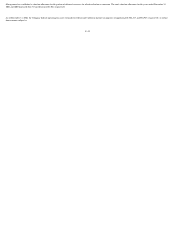

8. Income Taxes

Income tax expense differed from the amounts computed by applying the U.S. federal income tax rate of 34% to pretax loss as a result of the following:

Year Ended December 31,

2000 2001 2002

Expected tax benefit at U.S. federal statutory rate of 34% $ (19,503) $ (13,130) $ (7,463)

Current year net operating loss for which no tax benefit is recognized 16,574 11,330 4,105

Stock−based compensation 2,957 1,864 3,343

Other (28) (64) 15

Total income tax expense $ — $ — $ —

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and liabilities as of December 31, 2001 and 2002, are presented below:

As of December 31,

2001 2002

Deferred tax assets:

Net operating loss carryforwards $ 32,626 $ 34,270

Accruals and reserves 13,885 10,880

Other 20 80

Gross deferred tax assets 46,531 45,230

Less valuation allowance (46,531) (45,230)

Net deferred tax assets $ — $ —