NetFlix 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

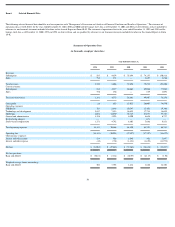

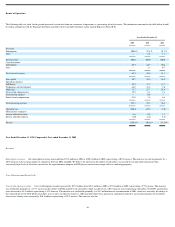

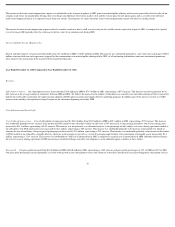

As of December 31,

1998 1999 2000 2001 2002

(in thousands)

Balance Sheet Data:

Cash and cash equivalents $ 1,061 $ 14,198 $ 14,895 $ 16,131 $ 59,814

Short−term investments — — — — 43,796

Working (deficit) capital (4,704) 11,028 (1,655) (6,656) 66,649

Total assets 4,849 34,773 52,488 41,630 130,530

Capital lease obligations, less current portion 172 811 2,024 1,057 460

Notes payable, less current portion — 3,959 1,843 — —

Subordinated notes payable — — — 2,799 —

Redeemable convertible preferred stock 6,321 51,819 101,830 101,830 —

Stockholders’ (deficit) equity (8,044) (32,028) (73,267) (90,504) 89,356

Year Ended December 31,

1998 1999 2000 2001 2002

(in thousands, except subscriber acquisition cost)

Other Data (Unaudited):

Number of subscribers at end of period NA 107 292 456 857

New trial subscribers during the period NA 127 515 566 1,140

Subscriber acquisition cost NA $ 110.79 $ 49.96 $ 37.16 $ 31.39

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and related notes.

Overview

We are the largest online entertainment subscription service in the United States providing more than 1,000,000 subscribers access to a comprehensive library of more than 14,500 movie,

television and other filmed entertainment titles. Our standard subscription plan allows subscribers to have three titles out at the same time with no due dates, late fees or shipping charges for

$19.95 per month. Subscribers can view as many titles as they want in a month. Subscribers select titles at our Web site (www.netflix.com) aided by our proprietary recommendation service,

receive them on DVD by first−class mail and return them to us at their convenience using our prepaid mailers. Once a title has been returned, we mail the next available title in a subscriber’s

queue.

We were organized as a Delaware corporation in August 1997. We have incurred significant losses since our inception. We may continue to incur losses, especially if the variable component

of our stock based compensation increases as a result of increases in our stock price.

On May 29, 2002, the Company closed the sale of 5,500,000 shares of common stock and on June 14, 2002, the Company closed the sale of an additional 825,000 shares of common stock, in

an initial public offering at a price of $15.00 per share. A total of $94,875,000 in gross proceeds was raised from these transactions. After deducting the underwriting fee of approximately

$6,641,000 and approximately $2,060,000 of other offering expenses, net proceeds were approximately $86,174,000. Upon the closing of the initial public offering, all preferred stock was

automatically converted into common stock.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires estimates and assumptions that affect the reported amounts

of assets and liabilities, revenues and expenses and related disclosures of contingent assets and liabilities in the consolidated financial

11