NetFlix 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

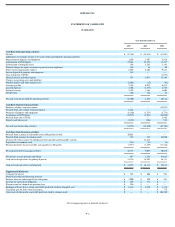

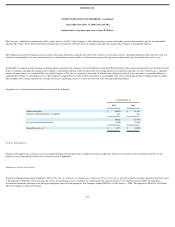

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

obligation as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long−lived assets that result from acquisition, construction, development,

and/or normal use of the assets. The Company also will record a corresponding asset that is depreciated over the life of the asset. Subsequent to the initial measurement of the asset retirement

obligation, the obligation will be adjusted at the end of each period to reflect the passage of time and changes in the estimated future cash flows underlying the obligation. The Company is

required to adopt SFAS No. 143 on January 1, 2003. The adoption of SFAS No. 143 is not expected to have a material effect on the Company’s financial statements.

In June 2002, the FASB issued SFAS No. 146, Accounting for Exit or Disposal Activities . SFAS 146 addresses significant issues regarding the recognition, measurement and reporting of

costs that are associated with exit and disposal activities, including restructuring activities that are currently accounted for pursuant to the guidance of Emerging Issues Task Force (“EITF”)

Issue No. 94−3, Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a Restructuring ). SFAS 146 is

effective for any restructurings initiated after December 31, 2002. The adoption of SFAS 146 may impact the timing of when the Company would record any future restructuring charges.

In November 2002, the EITF reached a consensus on Issue 02−16, Accounting by a Reseller for Cash Consideration Received from a Vendor , addressing the accounting of cash

consideration received by a customer from a vendor, including vendor rebates and refunds. The consensus reached states that consideration received should be presumed to be a reduction of

the prices of the vendor’s products or services and should therefore be shown as a reduction of cost of sales in the income statement of the customer. The presumption could be overcome if

the vendor receives an identifiable benefit in exchange for the consideration or the consideration represents a reimbursement of a specific incremental identifiable cost incurred by the

customer in selling the vendor’s product or service. If one of these conditions is met, the cash consideration should be characterized as a reduction of those costs in the income statement of

the customer. The consensus reached also concludes that if rebates or refunds can be reasonably estimated, such rebates or refunds should be recognized as a reduction of the cost of sales

based on a systematic and rational allocation of the consideration to be received relative to the transactions that mark the progress of the customer toward earning the rebate or refund. The

provisions of this consensus are not expected to have a significant effect on the Company’s financial position or operating results.

In November 2002, the EITF reached a consensus on Issue 00−21, Revenue Arrangements with Multiple Deliverables , addressing how to account for arrangements that involve the delivery

or performance of multiple products, services, and/or rights to use assets. Revenue arrangements with multiple deliverables are divided into separate units of accounting if the deliverables in

the arrangement meet the following criteria: (1) the delivered item has value to the customer on a standalone basis; (2) there is objective and reliable evidence of the fair value of undelivered

items; and (3) delivery of any undelivered item is probable. Arrangement consideration should be allocated among the separate units of accounting based on their relative fair values, with the

amount allocated to the delivered item being limited to the amount that is not contingent on the delivery of additional items or meeting other specified performance conditions. The final

consensus will be applicable to agreements entered into in fiscal periods beginning after June 15, 2003 with early adoption permitted. The provisions of this consensus are not expected to

have a significant effect on the Company’s financial position or operating results.

In November 2002, the FASB issued Interpretation No. 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness to Others,

an interpretation of FASB Statements No. 5, 57 and 107 and a rescission of FASB Interpretation No. 34 . This Interpretation elaborates on the disclosures to be made by a guarantor in its

interim and annual financial statements about its

F−14