NetFlix 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

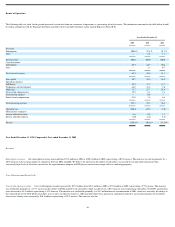

primarily to a modest increase in the percentage of titles subject to revenue sharing agreements mailed to our subscribers. Our postage and packaging costs increased by $14.5 million,

representing a 99% increase. Our postage rate per title in 2002 was lower than 2001, notwithstanding the rate for first−class postage increasing to $0.37 from $0.34 on June 30, 2002. This

postage rate per title decrease was attributable primarily to a full year benefit of reduced postage per title as a result of packaging improvements completed during the second quarter of 2001.

Our amortization of intangible assets increased by $0.8 million, representing a 43% increase. The increase in amortization was attributable to increases in intangible assets caused by our

obligation to issue additional shares to these studios upon dilution, which ceased immediately prior to our initial public offering.

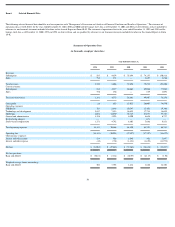

Gross profit . Our gross profit increased from $26.0 million in 2001 to $74.7 million in 2002, representing 34.3% and 48.9% of revenues, respectively. Our gross profit percentages

increased primarily as a result of the growth in our subscription revenues and a decrease in our direct incremental costs of providing those subscription services, coupled with the 21%

reduction in DVD amortization costs in 2002 as compared to 2001.

Operating Expenses

Fulfillment . Fulfillment expenses increased from $13.5 million in 2001 to $19.4 million in 2002, representing a 44% increase. This increase was attributable primarily to an increase in the

overall volume of the activities of our fulfillment operations and an increase in credit card fees from $3.2 million in 2001 to $4.9 million in 2002. As a percentage of revenues, fulfillment

expense decreased from 17.7% in 2001 to 12.7% in 2002 due primarily to a combination of an increasing revenue base and substantial improvements in our fulfillment productivity due to

our continuous efforts to refine and streamline our fulfillment operations, and a reduction in credit cards fees as a percentage of revenues from 4.2% in 2001 to 3.2% in 2002. The rate of

improvement in our fulfillment productivity may decrease in future periods as we reach diminishing marginal returns on the refinements and streamlining efforts to our operations. Credit

card fees increased due to an increase in subscription revenues.

Technology and development . Technology and development expenses decreased from $17.7 million in 2001 to $14.6 million in 2002, representing an 18% decrease. This decrease was

caused primarily by decreases in personnel costs as a result of employees terminated as part of our restructuring in 2001. As a percentage of revenues, technology and development expenses

decreased from 23.4% in 2001 to 9.6% in 2002 due primarily to an increase in revenues and a decrease in the absolute dollar amount we spent on technology and development.

Marketing . Our marketing expenses increased from $21.0 million in 2001 to $35.8 million in 2001, representing a 70% increase. This increase was attributable primarily to a 101%

increase in the number of new trial subscribers in 2002 compared to 2001, partially offset by decreases in the marketing cost per acquired subscriber from $37.16 to $31.39. The decrease in

the cost per acquired subscriber was due primarily to costs related to free trials and marketing staff and other costs increasing only moderately in absolute dollars but declining 16% on a per

acquired subscriber basis due to the large increase in new trial subscribers. As a percentage of revenues, marketing expenses decreased from 27.7% in 2001 to 23.4% in 2002 due primarily to

an increase in revenues.

General and administrative . Our general and administrative expenses increased from $4.7 million in 2001 to $6.7 million in 2002, representing a 45% increase. This increase was

attributable primarily to an increase in the number of personnel to support our increasing subscriber base as well as increased directors and officers insurance and property insurance costs and

additional professional fees caused by public company filing requirements. As a percentage of revenues, general and administrative expenses decreased from 6.1% in 2001 to 4.4% in 2002

due primarily to an increase in revenues.

Stock−based compensation . Stock−based compensation expense increased from $5.7 million, consisting of $5.3 million related to fixed awards and $0.4 million related to variable awards,

in 2001 to $9.8 million, consisting of $7.8 million related to fixed awards and $2.0 million related to variable awards, in 2002.

17