NetFlix 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

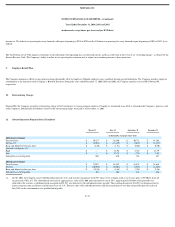

Options generally expire in 10 years, however, they may be limited to 5 years if the optionee owns stock representing more than 10% of the Company. Vesting periods are determined by the

stock plan administrator and generally provide for shares to vest ratably over three or four years.

Generally, the Company’s Board of Directors grants options at an exercise price of not less than the fair value of the Company’s common stock at the date of grant. In 2001, the Company

offered its employees the right to exchange certain employee stock options. The exchange resulted in the cancellation of employee stock options to purchase 0.9 million shares of common

stock with varying exercise prices in exchange for 0.9 million employee stock options with an exercise price of $3.00. The option exchange resulted in variable award accounting treatment

for all of the exchanged options. Variable award accounting will continue until all options subject to variable accounting are exercised, cancelled or expired.

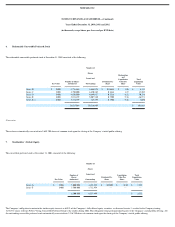

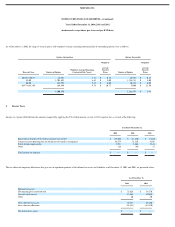

A summary of the activities related to the Company’s options for the years ended December 31, 2000, 2001 and 2002 and is as follows:

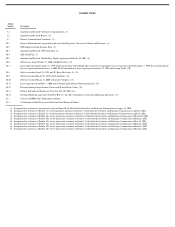

Shares Available for Grant

Options Outstanding

Number of Shares Weighted−Average

Exercise Price

Balances as of January 1, 2000 611,313 531,031 $ 4.041

Authorized 587,284 — —

Granted (849,466) 849,466 9.378

Exercised — (81,003) 5.229

Canceled 160,475 (160,475) 7.545

Repurchased 26,653 — 5.310

Balances as of December 31, 2000 536,259 1,139,019 7.443

Authorized 3,133,333 — —

Granted (3,457,659) 3,457,659 3.204

Exercised — (30,046) 4.146

Canceled 1,567,159 (1,567,159) 7.335

Repurchased 5,625 — —

Balances as of December 31, 2001 1,784,717 2,999,473 2.982

Authorized 666,667 — —

Granted (1,770,143) 1,770,143 4.090

Exercised — (441,083) 2.969

Canceled 228,003 (228,003) 3.649

Repurchased 1,729 —

Balances as of December 31, 2002 910,973 4,100,530 $ 3.424

Options exercisable as of December 31:

2000 185,684 $ 3.750

2001 918,252 $ 2.937

2002 1,288,533 $ 2.980

F−21