NetFlix 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

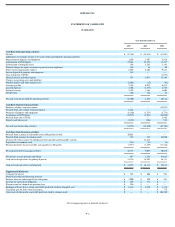

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

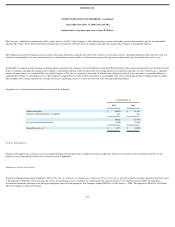

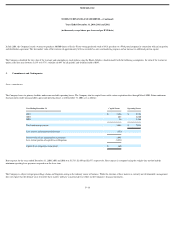

Marketing

Marketing consists of payroll and related costs, advertising, public relations, payments to marketing affiliates who drive subscriber traffic to the Company’s site and other costs related to

promotional activities including revenue−sharing payments, postage, packaging and DVD library amortization related to free trial periods. The Company expenses these costs as incurred.

Stock−based compensation

The Company accounts for its stock−based employee compensation plans using the intrinsic−value method. Deferred stock−based compensation expense is recorded if, on the date of grant,

the current market value of the underlying stock exceeds the exercise price. Deferred compensation resulting from repriced options is calculated pursuant to FASB Interpretation No. 44,

Accounting for Certain Transactions involving Stock Compensation . Options granted to nonemployees are considered compensatory and are accounted for at fair value pursuant to Statement

of Financial Accounting Standards (SFAS) No. 123, Accounting for Stock−Based Compensation . The Company discloses the pro forma effect of using the fair value method of accounting

for all employee stock−based compensation arrangements in accordance with SFAS No. 123.

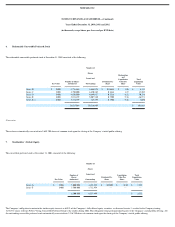

In 2001, the Company offered employees and directors the right to exchange certain stock options. The Company exchanged options to purchase approximately 900,000 shares of common

stock with varying exercise prices in exchange for options to purchase approximately 900,000 shares of common stock with an exercise price of $3.00 per share. As of December 31, 2002,

exchanged options for approximately 635,000 shares of common stock were outstanding. The stock option exchange resulted in variable award accounting treatment for all of the exchanged

options. Variable award accounting will continue until all options subject to variable accounting are exercised, cancelled or expire. Variable accounting treatment will result in unpredictable

and potentially significant charges or credits to the Company’s operating expenses from fluctuations in the market price of the Company’s common stock. For each hypothetical one−dollar

increase or decrease in the fair value of the Company’s common stock, the Company will record deferred compensation in an amount equal to the number of shares underlying the variable

awards multiplied by the one−dollar change. However, to the extent these variable awards are not fully vested, the stock−based compensation expense will be less than the amount recorded

as deferred compensation.

F−11