NetFlix 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

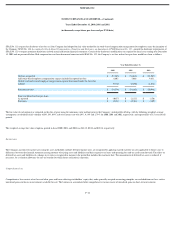

SFAS No. 123 requires the disclosure of net loss as if the Company had adopted the fair value method for its stock−based compensation arrangements for employees since the inception of

the Company. SFAS No. 148, Accounting for Stock−Based Compensation—Transition and Disclosure, an Amendment of FASB Statement No. 123 , amends the disclosure requirements of

SFAS No. 123 to require prominent disclosures in both annual and interim financial statements. Certain of the disclosures modifications are required for fiscal years ending after December

15, 2002 and are presented below. Had compensation cost been determined consistent with SFAS No. 123, the Company’s net loss and net loss per share would have been as follows:

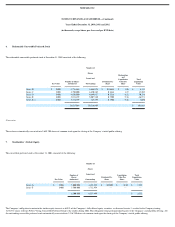

Year Ended December 31,

2000 2001 2002

Net loss as reported $ (57,363) $ (38,618) $ (21,947)

Add stock−based employee compensation expense included in reported net loss 8,803 5,686 9,831

Deduct total stock−based employee compensation expense determined under the fair value

method (9,714) (6,250) (8,832)

Pro forma net loss $ (58,274) $ (39,182) $ (20,948)

Basic and diluted net loss per share:

As reported $ (40.57) $ (21.15) $ (1.56)

Pro forma $ (41.21) $ (21.46) $ (1.49)

The fair value of each option was estimated on the date of grant using the minimum−value method, prior to the Company’s initial public offering, with the following weighted−average

assumptions: no dividend yield; volatility of 0%, 0%, 69%; risk−free interest rate of 6.24%, 4.14% and 2.79% for 2000, 2001 and 2002, respectively; and expected life of 3.5 years for all

periods.

The weighted−average fair value of options granted in fiscal 2000, 2001, and 2002 was $24.12, $0.32 and $10.38, respectively.

Income taxes

The Company accounts for income taxes using the asset and liability method. Deferred income taxes are recognized by applying enacted statutory tax rates applicable to future years to

differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. The effect on

deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The measurement of deferred tax assets is reduced, if

necessary, by a valuation allowance for any tax benefits for which future realization is uncertain.

Comprehensive loss

Comprehensive loss consists of net loss and other gains and losses affecting stockholders’ equity that, under generally accepted accounting principles, are excluded from net loss, such as

unrealized gains and losses on investments available for sale. The balances in accumulated other comprehensive income consist of unrealized gains on short−term investments.

F−12