NetFlix 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

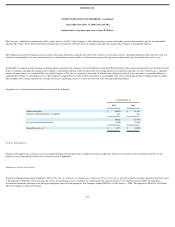

In July 2001, the Company issued a warrant to purchase 100,000 shares of Series F non−voting preferred stock at $9.38 per share to a Web portal company in connection with an integration

and distribution agreement. The fair market value of the warrants of approximately $18 was recorded as sales and marketing expense and an increase to additional paid−in capital.

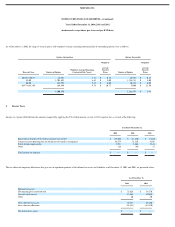

The Company calculated the fair value of the warrants and nonemployee stock options using the Black−Scholes valuation model with the following assumptions: the term of the warrant or

option; risk−free rates between 5.83% to 6.37%; volatility of 80% for all periods; and dividend yield of 0.0%.

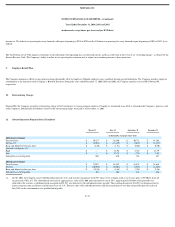

5. Commitments and Contingencies

Lease commitments

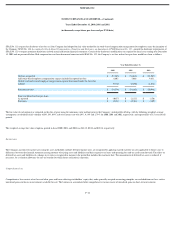

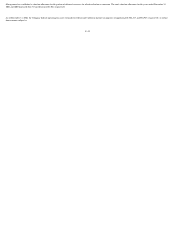

The Company leases its primary facilities under noncancelable operating leases. The Company also has capital leases with various expiration dates through March 2005. Future minimum

lease payments under noncancelable capital and operating leases as of December 31, 2002, are as follows:

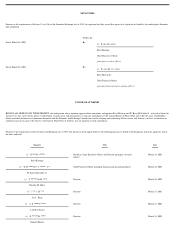

Year Ending December 31, Capital Leases Operating Leases

2003 $ 1,326 $ 2,952

2004 462 2,640

2005 56 1,466

Total minimum payments 1,844 $ 7,058

Less interest and unamortized discount (153)

Present value of net minimum lease payments 1,691

Less current portion of capital lease obligations (1,231)

Capital lease obligations, noncurrent $ 460

Rent expense for the years ended December 31, 2000, 2001 and 2002 was $1,533, $2,450 and $2,975, respectively. Rent expense is computed using the straight−line method and the

minimum operating lease payments required over the lease term.

The Company is subject to legal proceedings, claims and litigation arising in the ordinary course of business. While the outcome of these matters is currently not determinable, management

does not expect that the ultimate costs to resolve these matters will have a material adverse effect on the Company’s financial statements.

F−18