NetFlix 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

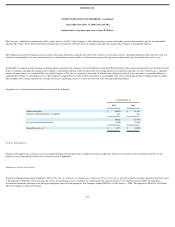

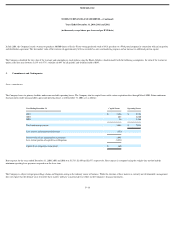

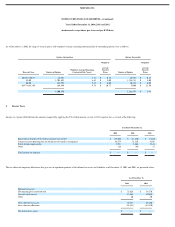

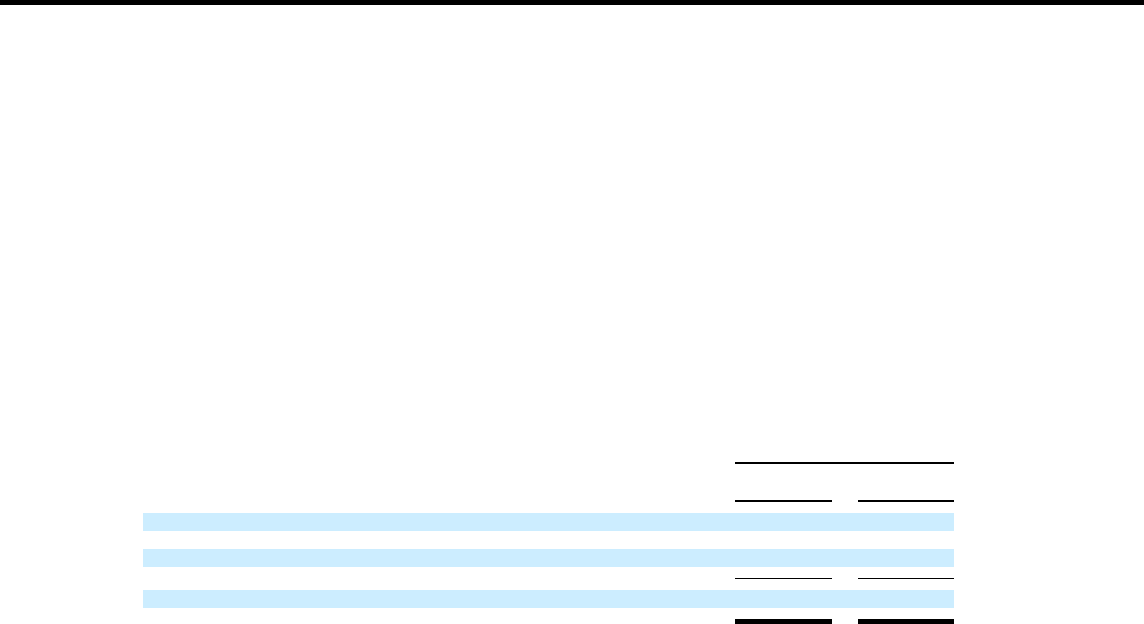

3. Accrued Expenses

Accrued expenses consisted of the following:

As of December 31,

2001 2002

Accrued state sales and use tax $ 2,379 $ 2,999

Employee benefits 1,476 2,592

Other 689 3,511

$ 4,544 $ 9,102

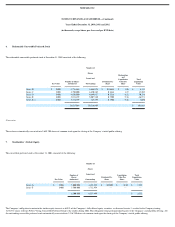

4. Debt and Warrants

Capital lease obligations

The Company has entered into capital leases for the acquisition of equipment. The Company has outstanding capitalized lease obligations under these arrangements of $2,402 and $1,691 as

of December 31, 2001 and December 31, 2002, respectively. Such amounts are payable in monthly installments of principal and interest with effective interest rates ranging between 14.4%

and 17.0% per annum.

Notes payable

The Company had a note payable to Lighthouse Capital Partners II, L.P. with an unpaid balance of $1,667 as of December 31, 2001. The note payable was secured by substantially all of the

assets of the Company, accrued interest at 12% per annum and was fully paid−off in August 2002.

Subordinated notes payable

In July 2001, the Company issued subordinated promissory notes and warrants to purchase 6,818,947 shares of its common stock at an exercise price of $3.00 per share for net proceeds of

$12,831. The subordinated notes had an aggregate face value of $13,000 and stated interest rate of 10%. Approximately $10,884 of the proceeds was allocated to the warrants as additional

paid−in capital and $1,947 was allocated to the subordinated notes payable. The resulting discount of $11,053 was being accreted to interest expense using an effective annual interest rate of

21%. The face value of the subordinated notes and all accrued interest were due and payable upon the earlier of July 2011 or the consummation of a qualified initial public offering. As of

December 31, 2001, accrued and unpaid interest of $650 was included in the carrying amount of the subordinated notes payable balance of $2,799 in the accompanying financial statements.

The Company consummated a qualified initial public offering on May 29, 2002 and repaid the face value and all accrued interest on the subordinated promissory notes. In April 2002, the

FASB issued FAS No. 145, Recision of FASB Statements no. 4, 44, and 64, Amendment of FASB Statement No. 13, and Technical Corrections Under Statement 4 , pursuant to which all

gains and losses from extinguishments of debt were required to be aggregated and, if material, classified as an extraordinary item, net of related income tax effect. This statement eliminates

Statement 4 and, thus, the exception to applying Opinion 30 to all gains and losses related to extinguishments of debt. The Company adopted FAS 145 during 2002, and as a result, has

classified the charge related to the unamortized discount upon repayment of the subordinated notes payable as other expense, instead of extraordinary loss on extinguishment of debt, in the

accompanying statements of operations.

F−16