NetFlix 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

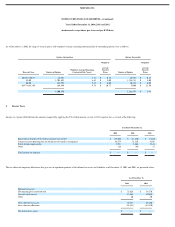

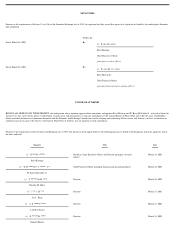

Warrants and common stock issued with debt instruments

In May 2000, in connection with a capital lease, the Company issued a warrant that provided the lender the right to purchase 7,669 shares of common stock at $19.56 per share. The

Company accounted for the fair value of the warrant of approximately $105 as an increase to additional paid−in capital with a corresponding provision to debt discount. The debt discount is

being accreted to interest expense over the term of the related debt, which is 36 months.

In July 2001, in connection with borrowings under subordinated promissory notes, the Company issued to the note holders warrants to purchase 6,818,947 shares of common stock. The

Company accounted for the fair value of the warrants of $10,884 as an increase to additional paid−in capital with a corresponding discount on subordinated notes payable.

In July 2001, in connection with a capital lease agreement, the Company granted warrants to purchase 85,000 shares of common stock at an exercise price of $3.00 per share. The fair value

of approximately $172 was recorded as an increase to additional paid−in capital with a corresponding reduction to the capitalized lease obligation. The debt discount is being accreted to

interest expense over the term of the lease agreement which is 45 months.

The fair values of warrants were estimated at the date of issuance of each warrant using the Black−Scholes valuation model with the following assumptions: the term of the warrant; risk−free

rates between 4.92% to 6.37%; volatility of 80% for all periods; and a dividend yield of 0.0%.

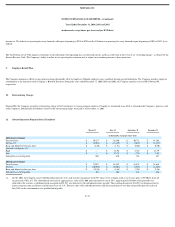

Warrants, options and common stock issued in exchange for cash and services rendered

In March 2000, in consideration for employee recruiting and placement services rendered, the Company issued 7,258 shares of common stock to a consultant. The Company recorded the fair

value of the common stock issued of $306 as marketing expense.

Also in March 2000, in consideration for marketing services rendered, the Company issued an option to a consultant to purchase 5,000 shares of common stock at $13.50 per share. The

Company recorded the fair value of the option of approximately $195 as marketing expense.

In April 2000, in connection with the sale of Series E preferred stock, the Company sold warrants to purchase 533,003 shares of Series E preferred stock at a price of $0.01 per share. The

warrants have an exercise price of $14.07 per share. The proceeds from the sale of these warrants were recorded as part of the issuance of Series E preferred stock in the accompanying

statement of stockholders’ (deficit) equity. In July 2001, in connection with a modification of the terms of the Series E preferred stock, certain Series E warrant holders agreed to the

cancellation of warrants to purchase 500,487 shares of Series E preferred stock. The remaining warrants to purchase 32,516 shares are exercisable at $14.07 per share.

In November 2000, in connection with an operating lease, the Company issued a warrant that provided the lessor the right to purchase 20,000 shares of common stock at $6.00 per share. The

Company also issued an option, in connection with the lease to a consultant to purchase 8,333 shares of common stock at $6.00 per share. The Company accounted for the fair value of the

warrant of approximately $216 as an increase to additional paid−in capital with a corresponding increase to other assets. This asset is being amortized over the term of the related operating

lease, which is five years. The Company recorded the fair value of the option of approximately $90 as general and administrative expense.

F−17