NetFlix 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

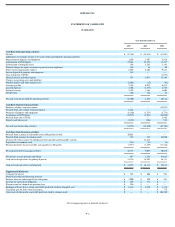

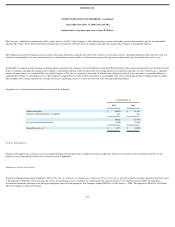

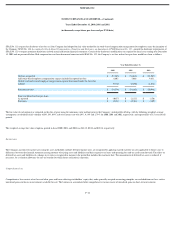

NETFLIX, INC.

STATEMENTS OF STOCKHOLDERS’ (DEFICIT) EQUITY AND COMPREHENSIVE LOSS

(in thousands, except share data)

Convertible

Preferred Stock Common Stock

Additional

Paid−in

Capital

Deferred

Stock−

Based

Compen−

sation

Accumulated

Other

Compre−

hensive

Income

Compre−

hensive

Loss

Accum−

ulated

Deficit

Total

Stock−

holders'

(Deficit)

Equity

Shares Amount Shares Amount

Balances as of January 1, 2000 4,444,545 $ 4 2,074,160 $ 2 $ 16,092 $ (6,841) $ — $ (41,285) $ (32,028)

Exercise of options and issuance of restricted stock — — 81,003 — 422 — — — 422

Repurchase of restricted stock — — (26,653) — (141) — — — (141)

Issuance of common stock in exchange for

services rendered — — 7,258 — 306 — — — 306

Warrants issued in connection with operating lease — — — — 216 — — — 216

Warrants issued in connection with services

rendered — — — — 285 — — — 285

Warrants issued in connection with debt financing — — — — 105 — — — 105

Subscribed Series F non−voting preferred stock — — — — 6,128 — — — 6,128

Deferred stock−based compensation, net — — — — 11,228 (11,228) — — —

Stock−based compensation expense — — — — — 8,803 — — 8,803

Net loss — — — — — — — $ (57,363) (57,363) (57,363)

Appreciation (depreciation) in value of

available−for−sale securities — — — — — — — — — —

Comprehensive loss — — — — — — — $ (57,363) — —

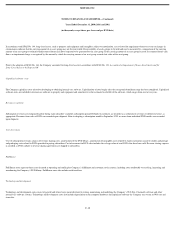

Balances as of December 31, 2000 4,444,545 4 2,135,768 2 34,641 (9,266) — (98,648) (73,267)

Exercise of options — — 30,046 — 125 — — — 125

Repurchase of restricted stock — — (5,625) — (12) — — — (12)

Issuance of common stock in exchange for

services rendered — — 1,666 — 10 — — — 10

Warrants issued in connection with subordinated

notes payable — — — — 10,884 — — — 10,884

Warrants issued in connection with capital lease

obligation — — — — 172 — — — 172

Warrants issued in exchange for services rendered — — — — 18 — — — 18

Issuance of Series F non−voting preferred stock 1,712,954 2 — — 4,279 — — — 4,281

Subscribed Series F non−voting preferred stock — — — — 217 — — — 217

Deferred stock−based compensation, net — — — — 2,145 (2,145) — — —

Stock−based compensation expense — — — — — 5,686 — — 5,686

Net loss — — — — — — — $ (38,618) (38,618) (38,618)

Appreciation (depreciation) in value of

available−for−sale securities — — — — — — — — — —

Comprehensive loss — — — — — — — $ (38,618) — —

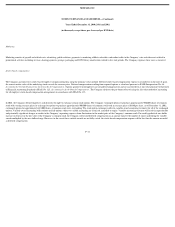

Balances as of December 31, 2001 6,157,499 6 2,161,855 2 52,479 (5,725) — (137,266) (90,504)

Exercise of options — — 438,838 — 1,287 — — — 1,287

Issuance of common stock under Employee Stock

Purchase Plan — — 47,746 — 363 — — — 363

Repurchase of restricted stock — — (1,729) — (6) — — — (6)

Issuance of Series F non−voting preferred stock 3,492,737 4 — — 1,314 — — — 1,318

Issuance of common stock, net of costs — — 6,328,084 6 86,208 — — — 86,214

Conversion of preferred stock into common stock (9,650,236) (10) 3,216,740 3 7 — — — —

Conversion of redeemable convertible preferred

stock into common stock — — 9,659,700 10 101,820 — — — 101,830

Issuance of common stock upon exercise of

warrants — — 594,561 1 195 — — — 196

Deferred stock−based compensation, net — — — — 15,505 (15,505) — — —

Stock−based compensation expense — — — — — 9,831 — — 9,831

Net loss — — — — — — — $ (21,947) (21,947) (21,947)

Appreciation (depreciation) in value of

available−for−sale securities — — — — — — 774 774 — 774

Comprehensive loss — — — — — — — $ (21,173) — —

Balances as of December 31, 2002 — $ — 22,445,795 $ 22 $ 259,172 $ (11,399) $ 774 $ (159,213) $ 89,356

See accompanying notes to financial statements.

F−5