NetFlix 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

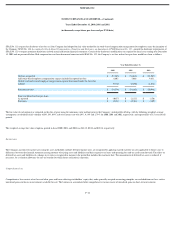

plan, shares of the Company’s common stock may be purchased over an offering period with a maximum duration of two years at 85% of the lower of the fair market value on the first day of

the applicable offering period or on the last day of the six−month purchase period. Employees may invest up to 15% of their gross compensation through payroll deductions. In no event shall

an employee be permitted to purchase more than 4,167 shares of common stock during any six−month purchase period. During the year ended December 31, 2002, employees purchased

47,746 shares at an average price of $7.60 per share. At December 31, 2002, 535,587 shares were reserved for future issuance. In addition, the plan provides for annual increases in the

number of shares available for issuance under the 2002 Employee Stock Purchase Plan on the first day of each fiscal year, beginning with fiscal year 2003, equal to the lesser of:

• 2% of the outstanding shares of the Company’s common stock on the first day of the applicable fiscal year;

• 333,333 shares; and

• such other amount as the Company’s board may determine.

Stock option plans

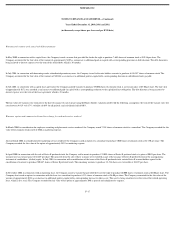

As of December 31, 2001, the Company was authorized to issue up to 4,879,978 shares of common stock in connection with its 1997 stock option plan for directors, employees and

consultants. The 1997 stock option plan provides for the issuance of stock purchase rights, incentive stock options or non−statutory stock options. 321,942 remaining shares reserved but not

yet issued under the 1997 plan as of the effective date of the Company’s initial public offering were added to the total reserved shares under the 2002 Stock Plan and deducted from the total

reserved shares under the 1997 Stock Plan.

In February 2002, the Company adopted the 2002 Stock Plan. The 2002 Stock Plan provides for the grant of incentive stock options to employees and for the grant of nonstatutory stock

options and stock purchase rights to employees, directors and consultants. The Company reserved a total of 666,667 shares of common stock for issuance under the 2002 Stock Plan. 321,942

remaining shares reserved but not yet issued under the 1997 plan as of the effective date of the Company’s initial public offering were added to the total reserved shares of 666,667 under the

2002 Stock Plan and deducted from the total reserved shares under the 1997 Stock Plan. In addition, the Company’s 2002 Stock Plan provides for annual increases in the number of shares

available for issuance under the Company’s 2002 Stock Plan on the first day of each fiscal year, beginning with the Company’s fiscal year 2003, equal to the lesser of 5% of the outstanding

shares of common stock on the first day of the applicable fiscal year, 1,000,000 shares, and another amount as the Company’s board of directors may determine.

Stock purchase rights are subject to a restricted stock purchase agreement whereby the Company has the right to repurchase the stock at the original issue price upon the voluntary or

involuntary termination of the purchaser’s employment with the Company. The repurchase rights lapse at a rate determined by the stock plan administrator but at a minimum rate of 25% per

year.

The exercise price for incentive stock options is at least 100% of the stock’s fair value on the date of grant for employees owning less than 10% of the voting power of all classes of stock,

and at least 110% of the fair value on the date of grant for employees owning more than 10% of the voting power of all classes of stock. For nonstatutory stock options, the exercise price is

also at least 110% of the fair value on the date of grant for service providers owning more than 10% of the voting power of all classes of stock and no less than 85% of the fair value on the

date of grant for service providers owning less than 10% of the voting power of all classes of stock.

F−20