NetFlix 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

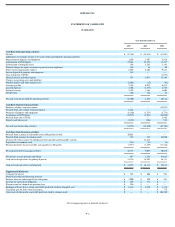

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS

Years Ended December 31, 2000, 2001 and 2002

(in thousands, except share, per share and per DVD data)

1. Organization and Significant Accounting Policies

Description of business

Netflix, Inc. (the “Company”), was incorporated on August 29, 1997 (inception) and began operations on April 14, 1998. The Company is an online subscriptions−based digital video disk

(“DVD”) rental service, providing subscribers with access to a comprehensive library of titles. For $19.95 a month, subscribers can rent as many DVDs as they want, with three movies out at

a time, and keep them for as long as they like. There are no due dates and no late fees. DVDs are delivered directly to the subscriber’s address by first−class mail from distribution centers

throughout the United States. The Company can reach more than half of its subscribers with generally next−day service. The Company also provides background information on DVD

releases, including reviews, member reviews and ratings and personalized movie recommendations. For more information on the company, visit www.netflix.com.

Initial public offering

On May 29, 2002, the Company closed the sale of 5,500,000 shares of common stock and on June 14, 2002, the Company closed the sale of an additional 825,000 shares of common stock, in

an initial public offering at a price of $15.00 per share. A total of $94,875 in gross proceeds was raised from these transactions. After deducting the underwriting fee of approximately $6,641

and approximately $2,060 of other offering expenses, net proceeds were approximately $86,174. Upon the closing of the initial public offering, all preferred stock was automatically

converted into common stock.

Cash and cash equivalents

The Company considers highly liquid instruments with original maturities of three months or less, at the date of purchase, to be cash equivalents. The Company’s cash and cash equivalents

are principally on deposit in short−term asset management accounts at two large financial institutions.

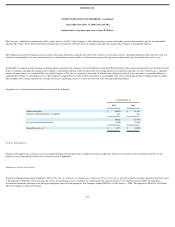

Short−term investments

Short−term investments generally mature between three months and five years from the purchase date. The Company has the ability to convert these short−term investments into cash at

anytime without penalty. All short−term investments are classified as available−for−sale and are recorded at market value using the specific identification method. Unrealized gains and

losses are reflected in other comprehensive loss and accumulated other comprehensive income. As of December 31, 2002, all short−term investments were invested in the Vanguard

Short−Term Bond Index Fund—Admiral Shares (the “Fund”). The target index, for the Fund, the Lehman 1−5 Year Government/Credit Bond Index (the “Index”), is comprised of

approximately 1,500 U.S. Treasury and agency securities and investment−grade corporate bonds with maturities between 1 and 5 years. As of December 31, 2002, the cost, unrealized gain

and market value was $43,022, $774 and $43,796, respectively.

DVD library

Historically, the Company purchased DVDs from studios and distributors. In 2000 and 2001, the Company entered into a series of revenue sharing agreements with several studios which

changed the business model for acquiring DVDs and satisfying subscriber demand. These revenue sharing agreements enable the Company to obtain DVDs at a lower up front cost than

under traditional buying arrangements. The Company shares a percentage of the actual net revenues generated by the use of each particular title with the studios over a fixed

F−7